Business, 15.04.2020 23:52 josueur9656

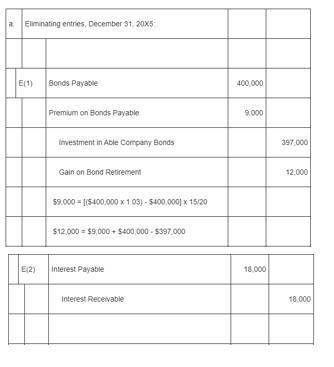

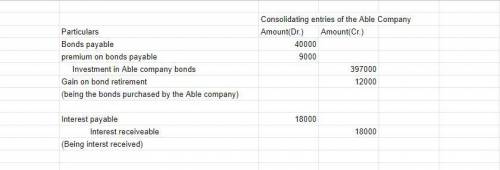

Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Able’s bonds from the original purchaser on December 31, 20X5, for $397,000. Prime owns 60 percent of Able’s voting common stock. a. Prepare the worksheet consolidation entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements for 20X5What is the bond premium?b. Prepare the worksheet consolidation entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements for 20X6.What is interest income?What is Interest Expense, Investment in Able. NCIof NA of Able

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

Suppose a firm faces a fixed price of output, 푝푝= 1200. the firm hires workers from a union at a daily wage, 푤푤, to produce output according to the production function 푞푞= 2퐸퐸12. there are 225 workers in the union. any union worker who does not work for this firm is guaranteed to find nonunion employment at a wage of $96 per day. a.what is the firm’s labor demand function? b.if the firm is allowed to choose 푤푤, but then the union decides how many workers to provide (up to 225) at that wage, what wage will the firm set? how many workers will the union provide? what is the firm’s output and profit? what is the total income of the 225 union workers? c.now suppose that the union sets the wage, but the firm decides how many workers to hire at that wage (up to 225). what wage will the union set to maximize the total income of all 225 workers? how many workers will the firm hire? what is the firm’s output and profit? what is the total income of the 225 union workers? [hint: to maximize total income of union, take the first order condition with respect to w and set equal to 0.]

Answers: 3

Business, 22.06.2019 21:10

An investor purchases 500 shares of nevada industries common stock for $22.00 per share today. at t = 1 year, this investor receives a $0.42 per share dividend (which is not reinvested) on the 500 shares and purchases an additional 500 shares for $24.75 per share. at t = 2 years, he receives another $0.42 (not reinvested) per share dividend on 1,000 shares and purchases 600 more shares for $31.25 per share. at t = 3 years, he sells 1,000 of the shares for $35.50 per share and the remaining 600 shares at $36.00 per share, but receives no dividends. assuming no commissions or taxes, the money-weighted rate of return received on this investment is closest to:

Answers: 3

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

Business, 22.06.2019 23:50

Jaguar has full manufacturing costs of their s-type sedan of £22,803. they sell the s-type in the uk with a 20% margin for a price of £27,363. today these cars are available in the us for $55,000 which is the uk price multiplied by the current exchange rate of $2.01/£. jaguar has committed to keeping the us price at $55,000 for the next six months. if the uk pound appreciates against the usd to an exchange rate of $2.15/£, and jaguar has not hedged against currency changes, what is the amount the company will receive in pounds at the new exchange rate?

Answers: 1

You know the right answer?

Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds...

Questions

Spanish, 17.12.2020 21:50

Social Studies, 17.12.2020 21:50

Chemistry, 17.12.2020 21:50

Mathematics, 17.12.2020 21:50

Mathematics, 17.12.2020 21:50

Mathematics, 17.12.2020 21:50

Chemistry, 17.12.2020 21:50

Mathematics, 17.12.2020 21:50

History, 17.12.2020 21:50

Physics, 17.12.2020 21:50

![=\$9000=[(400000\times1.03)-\$400000]\times\frac{15}{20}](/tpl/images/0603/6632/fd5df.png)