Business, 15.04.2020 03:12 jambunny26

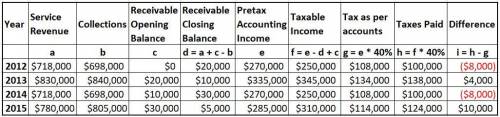

Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engagement, up to six months after services commence. Alsup recognizes service revenue for financial reporting purposes when the services are performed. For tax purposes, revenue is reported when fees are collected. Service revenue, collections, and pretax accounting income for 2012-2015 are as follows:

Service Revenue Collections Pretax Accounting Income2012 $718,000 $698,000 $270,0002013 830,000 840,000 335,0002014 795,000 775,000 305,0002015 780,000 805,000 285,000

There are no differences between accounting income and taxable income other than the temporary difference described above. The enacted tax rate for each year is 40%.(Hint: You may find it helpful to prepare a schedule that shows the balances in service revenue receivable at December 31, 2012-2015.)Required:1. Prepare the appropriate journal entry to record Alsup's 2013 income taxes.2. Prepare the appropriate journal entry to record Alsup's 2014 income taxes.3. Prepare the appropriate journal entry to record Alsup's 2015 income taxes.

Answers: 1

Another question on Business

Business, 21.06.2019 15:40

Plz i have no idea what a cover letter is can u guys explain it to me write a letter to the address below. you are responding to an advertisement from the willamette company for a job opening as an office assistant. you did some research and learned that the person to whom the application should be sent is ms. katrina n. d. waives. you are going to enclose a résumé and three letters of reference. your résumé will have details about your qualifications, so you should just give a brief but inviting overview of them here. in addition, your letter will include a very important paragraph that is not normally a part of a business letter. you will tell what format you are using for your letter where you got the information on this format. address of the willamette company: 355 buck hill road, portland, oregon 48792.

Answers: 1

Business, 22.06.2019 14:30

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

Business, 22.06.2019 17:00

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 22.06.2019 20:40

Answer the questions about keynesian theory, market economics, and government policy. keynes believed that there were "sticky" wages and that recessions are caused by increases in prices. decreases in supply. decreases in aggregate demand (ad). increases in unemployment. keynes believed the government should increase ad through increased government spending, but not tax cuts. control wages to increase employment because of sticky wages. increase employment through tax cuts only. increase as through tax cuts. increase ad through either increased government spending or tax cuts. intervene when individual markets fail by controlling prices and production.

Answers: 2

You know the right answer?

Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the...

Questions

Social Studies, 30.07.2019 04:50

Advanced Placement (AP), 30.07.2019 04:50

Arts, 30.07.2019 04:50

Mathematics, 30.07.2019 04:50

Geography, 30.07.2019 04:50

History, 30.07.2019 04:50

Biology, 30.07.2019 04:50