Business, 15.04.2020 03:20 sharpeyennifer

Ag-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fertilizer plant that processes and mixes petrochemical compounds into three brands of agricultural fertilizer: Greenup, Maintane, and Winterizer. The three brands differ with respect to selling price and the proportional content of basic chemicals.

The Fertilizer Manufacturing Division transfers the completed product to the cooperative’s Retail Sales Division at a price based on the cost of each type of fertilizer plus a markup. The Manufacturing Division is completely automated so that the only costs it incurs are for the petrochemical inputs plus automated conversion, which is committed for the coming period. The primary feedstock costs $1.50 per kilogram.

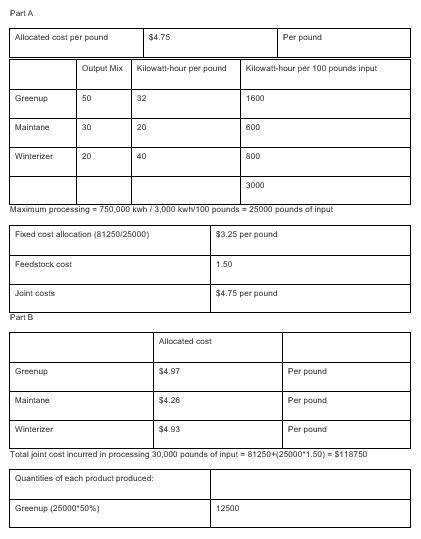

Each 1,000 kilograms of feedstock can produce either of the following mixtures of fertilizer:

Output Schedules (in kilograms) A B

Greenup 500 600

Maintane 300 100

Winterizer 200 300

Production is limited to the monthly capacity of the dehydrator at 750,000 kilowatt-hours. The different chemical makeup of each brand of fertilizer requires different dehydrator use as follows:

Product Kilowatt-Hour

Usage per Kilogram

Greenup 32

Maintane 20

Winterizer 40

Monthly conversion costs are $81,250. The company is producing according to output schedule A. Joint-production costs including conversion are allocated to each product on the basis of weight.

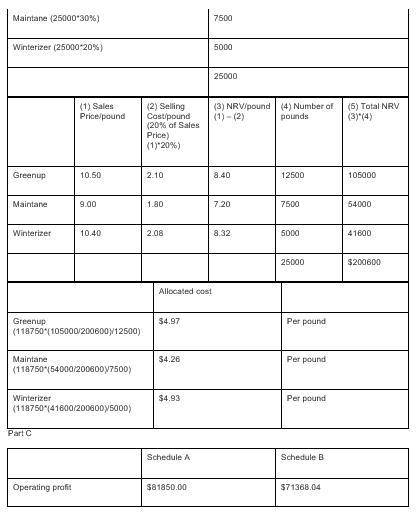

The fertilizer is packed into 50-kilogram bags for sale in the cooperative’s retail stores. The Manufacturing Division charges the retail stores its cost plus a markup. The sales price for each product charged by the cooperative’s Retail Sales Division is as follows:

Sales Price per Kilogram

Greenup $10.50

Maintane 9.00

Winterizer 10.40

Selling expenses are 20 percent of the sales price.

The manager of the Retail Sales Division has complained that the prices charged are excessive and that she would prefer to purchase from another supplier. The Manufacturing Division manager argues that the processing mix was determined based on a careful analysis of the costs of each product compared to the prices charged by the Retail Sales Division.

Required:

a. Assume that joint-production costs including conversion are allocated to each product on the basis of weight. What is the cost per kilogram of each product including conversion costs and the feedstock cost of $1.50 per kilogram, given the current production schedule?

b. Assume that joint-production costs including conversion are allocated to each product on the basis of net realizable value if it is sold through the cooperative’s Retail Sales Division. What is the allocated cost per kilogram of each product, given the current production schedule?

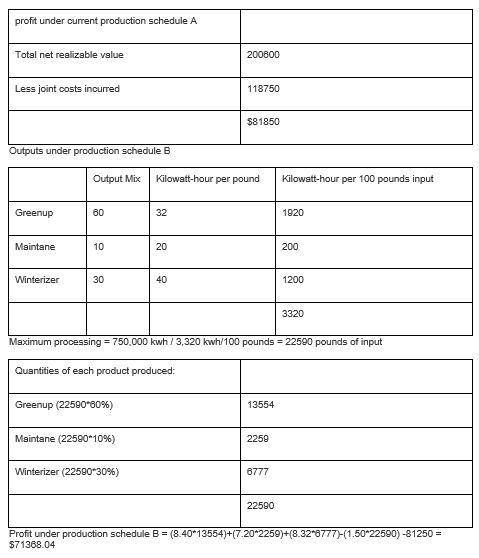

c. Assume that joint-production costs including conversion are allocated to each product on the basis of weight. Which of the two production schedules, A or B, produces the higher operating profit to the rm as a whole?

d. Would your answer to requirement (c) be different if joint-production costs including committed overhead were allocated to each product on the basis of net realizable value? Explain.

e. Can you recommend an approach to product planning that considers the organization’s overall profitability and avoids the divisional controversy? What are the costs and benefits of your recommended approach?

Answers: 2

Another question on Business

Business, 21.06.2019 15:40

Plz i have no idea what a cover letter is can u guys explain it to me write a letter to the address below. you are responding to an advertisement from the willamette company for a job opening as an office assistant. you did some research and learned that the person to whom the application should be sent is ms. katrina n. d. waives. you are going to enclose a résumé and three letters of reference. your résumé will have details about your qualifications, so you should just give a brief but inviting overview of them here. in addition, your letter will include a very important paragraph that is not normally a part of a business letter. you will tell what format you are using for your letter where you got the information on this format. address of the willamette company: 355 buck hill road, portland, oregon 48792.

Answers: 1

Business, 21.06.2019 18:30

Theodore is researching computer programming he thinks that this career has a great employment outlook so he’d like to learn if it’s a career in which he would excel what to skills are important for him to have and becoming a successful computer programmer

Answers: 3

Business, 22.06.2019 01:30

The gomez company, a merchandising firm, has budgeted its activity for december according to the following information: • sales at $500,000, all for cash. • merchandise inventory on november 30 was $250,000. • the cash balance at december 1 was $20,000. • selling and administrative expenses are budgeted at $50,000 for december and are paid for in cash. • budgeted depreciation for december is $30,000. • the planned merchandise inventory on december 31 is $260,000. • the cost of goods sold represents 75% of the selling price. • all purchases are paid for in cash. the budgeted cash disbursements for december are:

Answers: 3

Business, 22.06.2019 06:30

Double corporation acquired all of the common stock of simple company for

Answers: 2

You know the right answer?

Ag-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service d...

Questions

Mathematics, 06.05.2020 07:04

Physics, 06.05.2020 07:04

Social Studies, 06.05.2020 07:04

Mathematics, 06.05.2020 07:04

Mathematics, 06.05.2020 07:04

Mathematics, 06.05.2020 07:04

Mathematics, 06.05.2020 07:04