Business, 15.04.2020 03:41 raveransaw

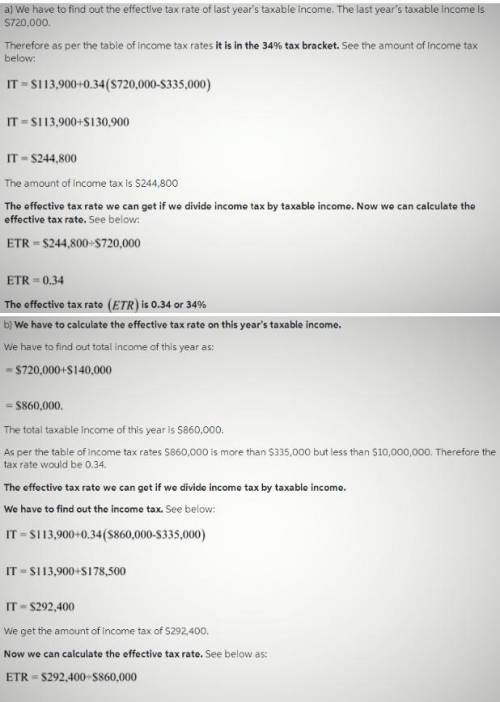

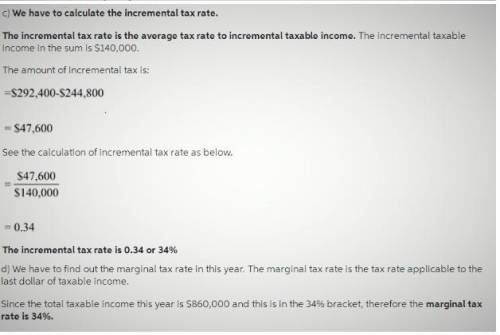

TenTec. in Sevierville, TN makes commercial and amateur radio equipment including receivers, transceivers, antenna tuners, linear amplifiers, etc. Their taxable income last year was $720,000. They have established a new line of electronic equipment that is on sale this year, and expected to add another $140,000 to taxable income. a) Determine the effective (average) tax rate on all of last year’s taxable income. b) Determine the effective (average) tax rate on all of this year’s taxable income. c) Determine the incremental tax rate. d) Determine the marginal tax rate this year.

Answers: 3

Another question on Business

Business, 22.06.2019 08:40

Gerda, a real estate agent, is selling a moderately priced house in a subdivision. she knows from her uncle that the factory being built half a mile from the subdivision will be manufacturing dog food, using a process that creates a very strong odor that permeates the surrounding neighborhood. a buyer, who is unaware of the type of factory under construction, makes an offer on one of the houses gerda is selling, and within a short time, the deal goes through. what does this scenario best illustrate?

Answers: 3

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 19:30

Exercise 4-9presented below is information related to martinez corp. for the year 2017.net sales $1,399,500 write-off of inventory due to obsolescence $80,440cost of goods sold 788,200 depreciation expense omitted by accident in 2016 43,600selling expenses 65,800 casualty loss 53,900administrative expenses 53,500 cash dividends declared 43,300dividend revenue 22,100 retained earnings at december 31, 2016 1,042,400interest revenue 7,420 effective tax rate of 34% on all items exercise 4-9 presented below is information relateexercise 4-9 presented below is information relate prepare a multiple-step income statement for 2017. assume that 61,500 shares of common stock are outstanding. (round earnings per share to 2 decimal places, e.g. 1.49.)prepare a separate retained earnings statement for 2017. (list items that increase retained earnings first.)

Answers: 2

Business, 22.06.2019 22:50

Awork system has five stations that have process times of 5, 9, 4, 9, and 8. what is the throughput time of the system? a. 7b. 4c. 18d. 35e. 9

Answers: 2

You know the right answer?

TenTec. in Sevierville, TN makes commercial and amateur radio equipment including receivers, transce...

Questions

History, 22.04.2020 22:56

Mathematics, 22.04.2020 22:56

History, 22.04.2020 22:56

Physics, 22.04.2020 22:56

Mathematics, 22.04.2020 22:56

Mathematics, 22.04.2020 22:56

English, 22.04.2020 22:56

Mathematics, 22.04.2020 22:56

History, 22.04.2020 22:56