Business, 15.04.2020 00:26 katherine78

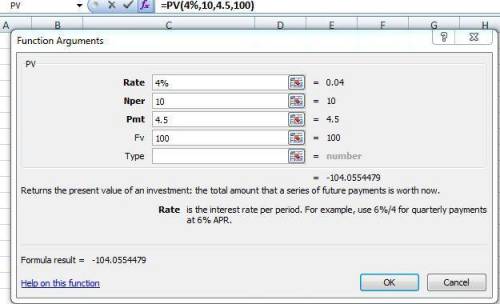

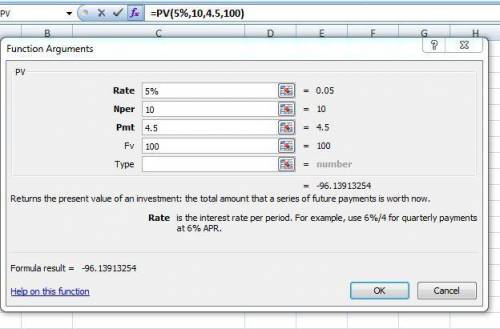

An AA-rated corporate bond has a yield to maturity of 10%. A U. S. Treasury security has a yield to maturity of 8%. These yields are quoted as APRs with semi-annual compounding. Both bonds pay semi-annual coupons at an annual rate of 9% (i. e., coupon rate) and have five years to maturity. The face value of both bonds is $100. a) What is the price of the Treasury bond? b) What is the price of the AA-rated corporate bond? c) What is the credit spread on the AA-bonds?

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Juwana was turned down for a car loan by a local credit union she thought her credit was good what should her first step be

Answers: 1

Business, 22.06.2019 09:50

Acar manufacturer uses new machines that automatically assemble an engine from parts fed to the system. the machine can regulate the speed ofassembly depending on the number of parts produced. which type of technology does this machine use? angenoem mense wat ons in matin en esta va ser elthe machine uses

Answers: 3

Business, 22.06.2019 20:20

Why is it easier for new entrants to get involved in radical innovations when compared to incumbent firms? a. unlike incumbent firms, new entrants do not have to face the high entry barriers, initially. b. new entrants are embedded in an innovation ecosystem, while incumbent firms are not. c. unlike incumbent firms, new entrants do not have formal organizational structures and processes. d. incumbent firms do not have the advantages of network effects that new entrants have.

Answers: 2

Business, 22.06.2019 20:50

Which of the statements best describes why the aggregate demand curve is downward sloping? an increase in the aggregate price level causes consumer and investment spending to fall, because consumer purchasing power decreases and money demand increases. as the aggregate price level increases, consumer expectations about the future change. as the aggregate price level decreases, the stock of existing physical capital increases. as a good's price increases, holding all else constant, the good's quantity demanded decreases.

Answers: 2

You know the right answer?

An AA-rated corporate bond has a yield to maturity of 10%. A U. S. Treasury security has a yield to...

Questions

Mathematics, 28.07.2021 06:50

Mathematics, 28.07.2021 07:00

Mathematics, 28.07.2021 07:00

Mathematics, 28.07.2021 07:00

Mathematics, 28.07.2021 07:00

Mathematics, 28.07.2021 07:00

Mathematics, 28.07.2021 07:00

History, 28.07.2021 07:00

Biology, 28.07.2021 07:00

Mathematics, 28.07.2021 07:00

Mathematics, 28.07.2021 07:00