Business, 10.04.2020 15:24 vorhees2406

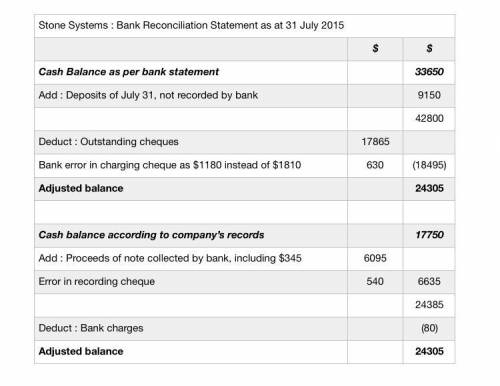

The cash account for Stone Systems at July 31, 20Y5, indicated a balance of $17,750. The bank statement indicated a balance of $33,650 on July 31, 20Y5. Comparing the bank statement and the accompanying canceled checks and memos with the records reveals the following reconciling items:

Checks outstanding totaled $17,865.

A deposit of $9,150, representing receipts of July 31, had been made too late to appear on the bank statement.

The bank had collected $6,095 on a note left for collection. The face of the note was $5,750.

A check for $390 returned with the statement had been incorrectly recorded by Stone Systems as $930. The check was for the payment of an obligation to Holland Co. for the purchase of office supplies on account.

A check drawn for $1,810 had been incorrectly charged by the bank as $1,180.

Bank service charges for July amounted to $80.

Required:

1. Prepare a bank reconciliation.

Stone Systems

Bank Reconciliation

July 31, 20Y5

Cash balance according to bank statement $

Adjustments:

Deposit of July 31, not recorded by bank $

Bank error in charging check as $1,180 instead of $1,810

Outstanding checks

Total adjustments

Adjusted balance $

Cash balance according to company's records $

Adjustments:

Proceeds of note collected by bank, including $345 interest $

Error in recording check by Stone Systems

Bank service charges

Total adjustments

Adjusted balance $

Feedback

1 & 3. Set up two sections: one for the company cash account section and the other for the bank balance section. Determine the effect of the data on each section. Recall that when you are finished, the adjusted balances in the bank and company sections of the reconciliation must be equal. If not, an item has been overlooked or treated in error.

Recall that the company's cash account balance is updated for any items in the company section of the bank reconciliation.

Answers: 2

Another question on Business

Business, 22.06.2019 06:30

Selected data for stick’s design are given as of december 31, year 1 and year 2 (rounded to the nearest hundredth). year 2 year 1 net credit sales $25,000 $30,000 cost of goods sold 16,000 18,000 net income 2,000 2,800 cash 5,000 900 accounts receivable 3,000 2,000 inventory 2,000 3,600 current liabilities 6,000 5,000 compute the following: 1. current ratio for year 2 2. acid-test ratio for year 2 3. accounts receivable turnover for year 2 4. average collection period for year 2 5. inventory turnover for year 2

Answers: 2

Business, 22.06.2019 15:00

Why entrepreneurs start businesses. a) monopolistic competition b) perfect competition c) sole proprietorship d) profit motive

Answers: 1

Business, 22.06.2019 17:00

Which represents a surplus in the market? a market price equals equilibrium price. b quantity supplied is greater than quantity demanded. c market price is less than equilibrium price. d quantity supplied equals quantity demanded.

Answers: 2

Business, 22.06.2019 19:00

For each of the following cases determine the ending balance in the inventory account. (hint: first, determine the total cost of inventory available for sale. next, subtract the cost of the inventory sold to arrive at the ending balance.)a. jill’s dress shop had a beginning balance in its inventory account of $40,000. during the accounting period jill’s purchased $75,000 of inventory, returned $5,000 of inventory, and obtained $750 of purchases discounts. jill’s incurred $1,000 of transportation-in cost and $600 of transportation-out cost. salaries of sales personnel amounted to $31,000. administrative expenses amounted to $35,600. cost of goods sold amounted to $82,300.b. ken’s bait shop had a beginning balance in its inventory account of $8,000. during the accounting period ken’s purchased $36,900 of inventory, obtained $1,200 of purchases allowances, and received $360 of purchases discounts. sales discounts amounted to $640. ken’s incurred $900 of transportation-in cost and $260 of transportation-out cost. selling and administrative cost amounted to $12,300. cost of goods sold amounted to $33,900.a& b. cost of goods avaliable for sale? ending inventory?

Answers: 1

You know the right answer?

The cash account for Stone Systems at July 31, 20Y5, indicated a balance of $17,750. The bank statem...

Questions

Health, 30.09.2019 04:50

Chemistry, 30.09.2019 04:50

History, 30.09.2019 04:50

Social Studies, 30.09.2019 04:50

Mathematics, 30.09.2019 04:50

Mathematics, 30.09.2019 04:50

Social Studies, 30.09.2019 04:50

Mathematics, 30.09.2019 04:50