Business, 08.04.2020 04:44 zamirareece17

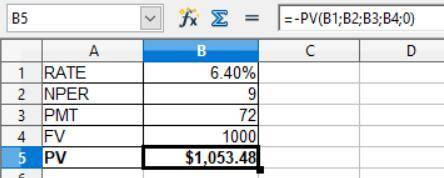

Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $ 1 comma 000, and a coupon rate of 7.2 % (annual payments). The yield to maturity on this bond when it was issued was 6.4 %. Assuming the yield to maturity remains constant, what is the price of the bond immediately before it makes its first coupon payment? Before the first coupon payment, the price of the bond is $ nothing. (Round to the nearest cent.)

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

17. chef a says that garnish should be added to a soup right before serving. chef b says that garnish should be cooked with the other ingredients in a soup. which chef is correct? a. chef a is correct. b. both chefs are correct. c. chef b is correct. d. neither chef is correct. student c incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

Business, 22.06.2019 19:30

Which of the following constitute the types of unemployment occurring at the natural rate of unemployment? a. frictional and cyclical unemployment.b. structural and frictional unemployment.c. cyclical and structural unemployment.d. frictional, structural, and cyclical unemployment.

Answers: 2

Business, 22.06.2019 20:00

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

You know the right answer?

Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a fac...

Questions

Mathematics, 02.02.2021 20:40

English, 02.02.2021 20:40

Physics, 02.02.2021 20:40

History, 02.02.2021 20:40

Chemistry, 02.02.2021 20:40

Social Studies, 02.02.2021 20:40

Mathematics, 02.02.2021 20:40

Mathematics, 02.02.2021 20:40