Business, 08.04.2020 00:50 zriggi2528

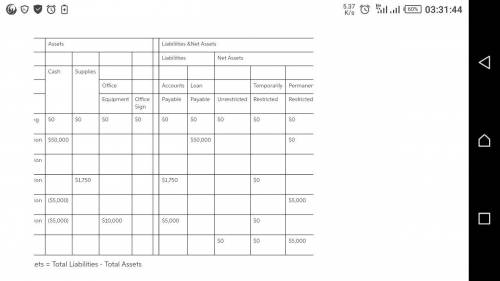

Shanna Engel started up a new nonprofit organization in 2013 named Concern for Animal Shelter and Habitats (CASH). The organization places homeless animals in permanent homes. Transactions during the first month of operations were as follows:

1. Borrowed $ 50,000 from a local bank. No interest is due on the loan during the first month, and the principal does not have to be paid back for two years.

2. Signed a contract with a local carpenter to build a fence to enclose the backyard. The carpenter charges $ 250 per hour and expects the fence to take 10 hours to complete. He expects to begin work next month.

3. CASH bought 50 bags of dog food and 25 bags of cat food. Dog food costs $ 20 per bag, while cat food costs $ 30 per bag. The pet food was bought on credit (i. e., CASH has not yet paid for the supplies).

4. CASH bought a sign to hang in front of its building. The sign cost $ 5,000 and CASH paid for it when it was received.

5. Purchased and received an office computer, server, printer, and copier. The total cost of the equipment was $ 10,000, half of which was paid and the other half was still owed.

Show the impact of these transactions on the fundamental equation of accounting.

Answers: 1

Another question on Business

Business, 22.06.2019 09:30

Darlene has a balance of 3980 on a credit card with an apr of 22.8% paying off her balance and which of these lengths of time will result in her paying the least amount of interest?

Answers: 2

Business, 22.06.2019 10:30

How are interest rates calculated by financial institutions? financial institutions generally calculate interest as (1) interest or (.

Answers: 1

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 12:50

Kyle and alyssa paid $1,000 and $4,000 in qualifying expenses for their two daughters jane and jill, respectively, to attend the university of california. jane is a sophomore and jill is a freshman. kyle and alyssa's agi is $135,000 and they file a joint return. what is their allowable american opportunity tax credit after the credit phase-out based on agi is taken into account?

Answers: 1

You know the right answer?

Shanna Engel started up a new nonprofit organization in 2013 named Concern for Animal Shelter and Ha...

Questions

Mathematics, 22.06.2019 04:30

History, 22.06.2019 04:30

Mathematics, 22.06.2019 04:30

Mathematics, 22.06.2019 04:30

Mathematics, 22.06.2019 04:30

Biology, 22.06.2019 04:30