Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, and tubular products. The company's income statement for the 2016 fiscal year reported the following information ($ in millions):

Sales $ 6,100

Cost of goods sold 5,100

The company's balance sheets for 2016 and 2015 included the following information ($ in millions):

2016 2015

Current assets:

Accounts receivable, net $ 702 $ 602

Inventories 890 814

The statement of cash flows reported bad debt expense for 2016 of $6 million. The summary of significant accounting policies included the following notes ($ in millions):

Accounts Receivable (in part)

The allowance for uncollectible accounts was $8 and $5 at December 31, 2016 and 2015, respectively. All sales are on credit.

Inventories

Inventories are valued at the lower of cost or market. The cost of the majority of inventories is measured using the last in, first out (LIFO) method. Other inventories are measured principally at average cost and consist mostly of foreign inventories and certain raw materials. If the entire inventory had been valued on an average cost basis, inventory would have been higher by $460 and $310 at the end of 2016 and 2015, respectively.

During 2016, 2015, and 2014, liquidation of LIFO layers generated income of $4, $5, and $23, respectively.

Required:

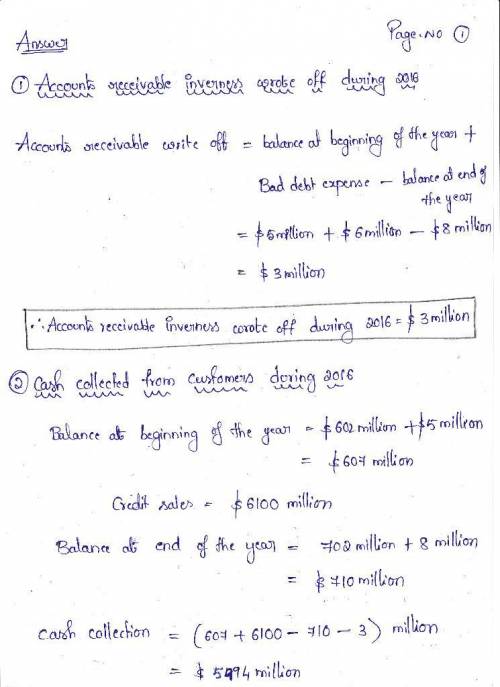

1.

Determine the amount of accounts receivable Inverness wrote off during 2016. (Enter your answer in millions.)

2.

Calculate the amount of cash collected from customers during 2016. (Enter your answer in millions.)

3.

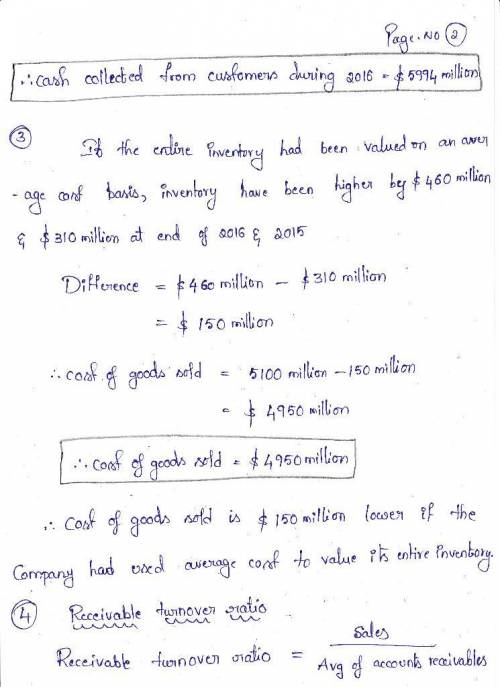

Calculate what cost of goods sold would have been for 2016 if the company had used average cost to val

4.

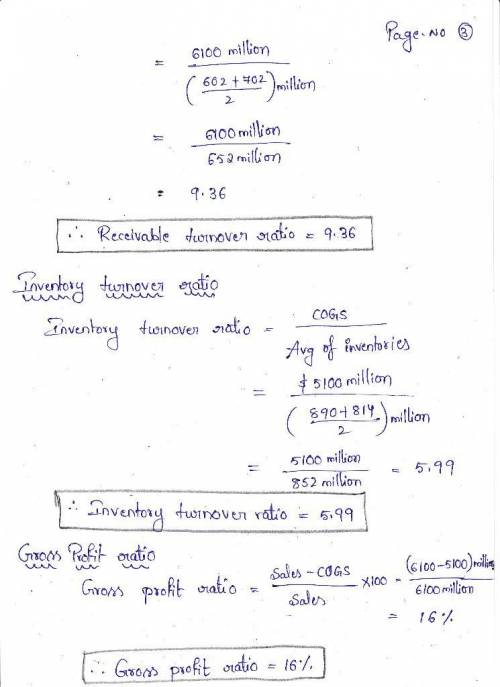

Calculate the following ratios for 2016. (Round "Receivables turnover ratio" and "Inventory turnover ratio" answers to 2 decimal places. Round "Gross profit ratio" answer to nearest percent (i. e., 0.123 needs to be entered as 12%).)

ue its entire inventory. (Enter your answer in millions.)

Answers: 3

Another question on Business

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 22.06.2019 17:00

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 18:00

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

Business, 22.06.2019 19:40

The following cost and inventory data are taken from the accounting records of mason company for the year just completed: costs incurred: direct labor cost $ 90,000 purchases of raw materials $ 134,000 manufacturing overhead $ 205,000 advertising expense $ 45,000 sales salaries $ 101,000 depreciation, office equipment $ 225,000 beginning of the year end of the year inventories: raw materials $ 8,100 $ 10,300 work in process $ 5,900 $ 21,000 finished goods $ 77,000 $ 25,800 required: 1. prepare a schedule of cost of goods manufactured. 2. prepare the cost of goods sold section of mason company’s income statement for the year.

Answers: 3

You know the right answer?

Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, an...

Questions

Computers and Technology, 07.11.2019 04:31