Business, 07.04.2020 21:51 milkshakegrande101

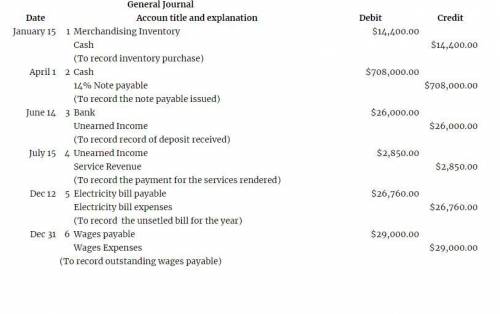

Vigeland Company completed the following transactions during Year 1. Vigeland’s fiscal year ends on December 31. Jan. 15 Purchased and paid for merchandise. The invoice amount was $14,400; assume a perpetual inventory system. Apr. 1 Borrowed $708,000 from Summit Bank for general use; signed a 10-month, 14% annual interest-bearing note for the money. June 14 Received a $26,000 customer deposit for services to be performed in the future. July 15 Performed $2,850 of the services paid for on June 14. Dec. 12 Received electric bill for $26,760. Vigeland plans to pay the bill in early January. 31 Determined wages of $29,000 were earned but not yet paid on December 31 (disregard payroll taxes). 2. Prepare the adjusting entries required on December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Answers: 1

Another question on Business

Business, 22.06.2019 12:30

Amap from a trade development commission or chamber of commerce can be more useful than google maps for identifying

Answers: 1

Business, 22.06.2019 23:40

When randy, a general manager of a national retailer, moved to a different store in his company that was having difficulty, he knew that sales were low and after talking to his employees, he found morale was also low. at first randy thought attitudes were poor due to low sales, but after working closely with employees, he realized that the poor attitudes were actually the cause of poor sales. randy was able to discover the cause of the problem by utilizing skills.

Answers: 2

Business, 23.06.2019 02:00

Donna and gary are involved in an automobile accident. gary initiates a lawsuit against donna by filing a complaint. if donna files a motion to dismiss, she is asserting that

Answers: 1

Business, 23.06.2019 10:00

Brody and tanya recently sold some land they owned for $150,000. they received the land five years ago as a wedding gift from brody's aunt jeanette. she had already given them cash equal to the annual exclusion during that year. aunt jeanette purchased the land many years ago when the property was worth $20,000. at the time of the gift, the property was worth $100,000 and aunt jeanette paid $47,000 in gift tax. what is the long term capital gain on the sale of the property

Answers: 3

You know the right answer?

Vigeland Company completed the following transactions during Year 1. Vigeland’s fiscal year ends on...

Questions

English, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

History, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

English, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

History, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

Mathematics, 25.09.2021 15:50

Biology, 25.09.2021 16:00

Physics, 25.09.2021 16:00

Mathematics, 25.09.2021 16:00