Business, 07.04.2020 01:26 emmmmmily997

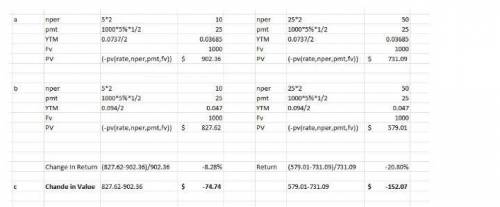

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bonds.

Bond A Bond B

Coupon rate 5.00% 5.00%

Time to maturity 5 years 25 years

Required return 7.37% 7.37%

a. Calculate the values of Bond A and Bond B. (Round your answers to 2 decimal places.)

b. Recalculate the bonds’ values if the required rate of return changes to 9.40%. (Round your answers to 2 decimal places.)

c. Calculate the increase or decrease in bond value based on the change in required return. (Round your answers to 2 decimal places.)

Answers: 1

Another question on Business

Business, 22.06.2019 10:30

The card shoppe needs to maintain 21 percent of its sales in net working capital. currently, the store is considering a four-year project that will increase sales from its current level of $349,000 to $408,000 the first year and to $414,000 a year for the following three years of the project. what amount should be included in the project analysis for net working capital in year 4 of the project?

Answers: 3

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 19:20

Win goods inc. is a large multinational conglomerate. as a single business unit, the company's stock price is estimated to be $200. however, by adding the actual market stock prices of each of its individual business units, the stock price of the company as one unit would be $300. what is win goods experiencing in this scenario? a. diversification discount b. learning-curveeffects c. experience-curveeffects d. economies of scale

Answers: 1

You know the right answer?

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bon...

Questions

Law, 11.11.2020 17:50

Computers and Technology, 11.11.2020 17:50

Health, 11.11.2020 17:50

Biology, 11.11.2020 17:50

Mathematics, 11.11.2020 17:50

Physics, 11.11.2020 17:50

Computers and Technology, 11.11.2020 17:50

Social Studies, 11.11.2020 17:50