Business, 07.04.2020 01:19 wfergphilly3159

During 2015, Wright Company sells 470 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for 2015.

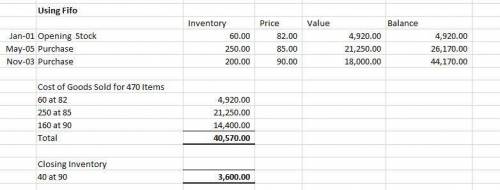

Calculate ending inventory and cost of goods sold for 2015, assuming the company uses FIFO.

Date Transaction Number of Units Unit Cost Total Cost

Jan. 1 Beginning inventory 60 $82 $4,920

May 5 Purchase 250 85 21,250

Nov. 3 Purchase 200 90 18,000

510 $44,170

Calculate ending inventory and cost of goods sold for the year, assuming the company uses specific identification. Actual sales by the company include its entire beginning inventory, 275 units of inventory from the May 5 purchase, and 220 units from the November 3 purchase.

Answers: 3

Another question on Business

Business, 21.06.2019 16:10

Visburg concrete company pours concrete slabs for single-family dwellings. lancing construction company, which operates outside visburg's normal sales territory, asks visburg to pour 40 slabs for lancing's new development of homes. visburg has the capacity to build 300 slabs and is presently working on 250 of them. lancing is willing to pay only $3, 300 per slab. visburg estimates the cost of a typical job to include unit-level materials, $1, 440: unit-level labor, $720: and an allocated portion of facility-level overhead, $1, 200. required calculate the contribution to profit from the special order. should visburg accept or reject the special order to pour 40 slabs for $3, 300 each?

Answers: 2

Business, 21.06.2019 16:40

Elephant, inc.'s cost of goods sold for the year is $2,000,000, and the average merchandise inventory for the year is $129,000. calculate the inventory turnover ratio of the company. (round your answer to two decimal places.)

Answers: 1

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 16:30

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

You know the right answer?

During 2015, Wright Company sells 470 remote-control airplanes for $110 each. The company has the fo...

Questions

Mathematics, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00

English, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00

Biology, 09.03.2021 01:00

Mathematics, 09.03.2021 01:00