Business, 04.04.2020 11:57 Hellokittyjam35

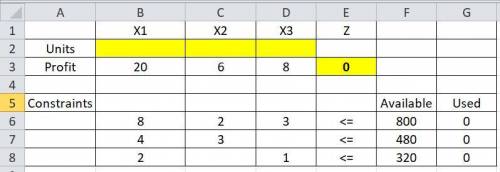

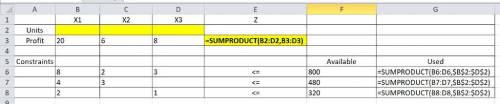

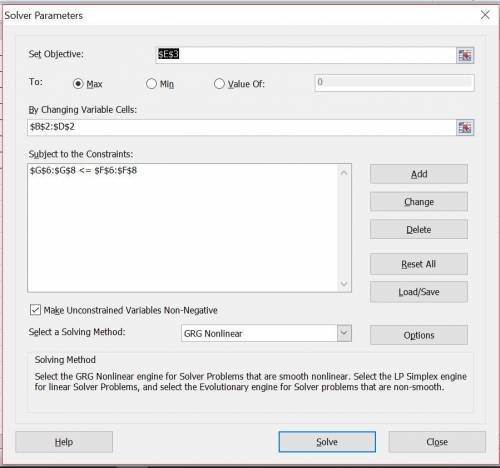

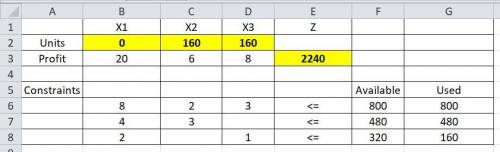

A manufacturing firm has discontinued the production of a certain unprofitable product line. Considerable excess production capacity was created as a result. Management is considering devoting this excess capacity to one or more of three products: X1, X2, and X3. Machine hours required per unit are: PRODUCT MACHINE TYPE X1 X2 X3Milling machine 8 2 3Lathe 4 3 0Grinder 2 0 1The available time in machine hours per week isMACHINE HOURS PER WEEKMilling machines 800Lathes 480Grinders 320The salespeople estimate they can sell all the units of X1 and X2 that can be made, But the sales potential of X3 is 80 units per week maximum. Unit profits for the three products are $20 (for X1), $6 (for X2), and $8 (for X3).Required:(a) Write the mathematical formulation to maximize the profit per week (Decision variables: Production amount of X1, X2, and X3).(b) Solve the mathematical formulation using Excel Solver. Show your work.(c) What is the optimal solution?

Answers: 1

Another question on Business

Business, 22.06.2019 16:00

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 22:40

Effective capacity is the: a. capacity a firm expects to achieve given the current operating constraints.b. minimum usable capacity of a particular facility.c. sum of all the organization's inputs.d. average output that can be achieved under ideal conditions.e. maximum output of a system in a given period.

Answers: 1

Business, 23.06.2019 02:00

Suppose that a major city’s main thoroughfare, which is also an interstate highway, will be completely closed to traffic for two years, from january 2014 to december 2015, for reconstruction at a cost of $535 million. if the construction company were to keep the highway open for traffic during construction, the highway reconstruction project would take much longer and be more expensive. suppose that construction would take four years if the highway were kept open, at a total cost of $800 million. the state department of transportation had to make its decision in 2014, one year before the start of construction (so that the first payment was one year away). so the department of transportation had the following choices: (i) close the highway during construction, at an annual cost of $267.5 million per year for two years. (ii) keep the highway open during construction, at an annual cost of $200 million per year for four years. now suppose the interest rate is 80%. calculate the present value of the costs incurred under each plan.

Answers: 3

Business, 23.06.2019 14:20

Suppose a mutual fund qualifies as having moderate risk if the standard deviation of its monthly rate of return is less than 3%. a mutual-fund rating agency randomly selects 27 months and determines the rate of return for a certain fund. the standard deviation of the rate of return is computed to be 2.19%. is there sufficient evidence to conclude that the fund has moderate risk at the alpha equals 0.05 level of significance? a normal probability plot indicates that the monthly rates of return are normally distributed.

Answers: 2

You know the right answer?

A manufacturing firm has discontinued the production of a certain unprofitable product line. Conside...

Questions

Health, 30.07.2019 18:30

Mathematics, 30.07.2019 18:30

Mathematics, 30.07.2019 18:30

English, 30.07.2019 18:30

History, 30.07.2019 18:30

Mathematics, 30.07.2019 18:30

Health, 30.07.2019 18:30

Physics, 30.07.2019 18:30

Physics, 30.07.2019 18:30

Mathematics, 30.07.2019 18:30

History, 30.07.2019 18:30

Mathematics, 30.07.2019 18:30