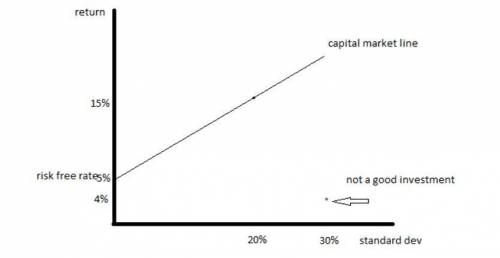

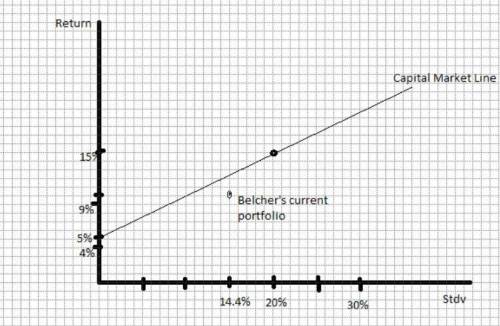

For all parts of this question, assume the following: The CAPM holds. The riskless rate of return is 5%. The market portfolio has expected rate of return of 15% and standard deviation of 20%. 1. Burger Inc. stock has an expected rate of return of 4% per year and standard deviation of 30%. Linda Belcher says, "No rational person would hold a risky asset expected to return less than the riskless rate! It must be mispriced." Is Linda correct? Explain. 2. Consider the following data on two stocks whose returns have a correlation of 0.2 with each other: Expected Return Standard Deviation Walmart 5% 12% Tesla 20% 35% Bob Belcher owns $25,000 worth of Walmart stock, $10,000 worth of Tesla stock, and no other investments. a) Compute expected rate of return (% per year), and standard deviation of Bob’s portfolio. b) Mr. Belcher says he cannot tolerate any more standard deviation than her portfolio has now. Given this risk tolerance, is he maximizing her expected return? If he is, explain why? If he is not, explain how she should invest to maximize expected return (give a specific trading and investment strategy).

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Identify the management, organization, and technology factors responsible for slow adoption rates of internal corporate social networks.when a company decides to launch a social networking program the management, all need to be on board with the launch. from the ceo down to the shift or assistant manager everyone needs to know its coming and be excited. the organization of such a launch needs to be mapped out, and training provided for the new systems. within the company, they need to make sure the technology at hand (computers, tablets, and company phones), are all compatible with the system. when a company launches a new system, and the find that the employees are not adopting it, they need to investigate the reasons. is the management at all level's onboard? did we organize the launch properly? do we have the right technology for the system? things can goeither way but if

Answers: 2

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 23.06.2019 00:40

Mesa company produces wooden rocking chairs. the company has two production departments, cutting and assembly. the wood is cut and sanded in cutting and then transferred to assembly to be assembled and painted. from assembly, the chairs are transferred to finished goods inventory and then are sold.mesa has compiled the following information for the month of february: cutting department assemblydepartmentdirect materials $ 73,000 $ 13,000direct labor 73,000 108,000applied manufacturing overhead 159,000 171,000cost of goods completed and transferred out 233,000 255,000required: 1, 2, 3, & 4. prepare journal entries for the transactions in the cutting and assembly departments of mesa company. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)

Answers: 3

You know the right answer?

For all parts of this question, assume the following: The CAPM holds. The riskless rate of return is...

Questions

Mathematics, 31.07.2019 05:30

History, 31.07.2019 05:30

Geography, 31.07.2019 05:30

Mathematics, 31.07.2019 05:30

History, 31.07.2019 05:30

Mathematics, 31.07.2019 05:30