Business, 04.04.2020 10:49 amoakoh800003

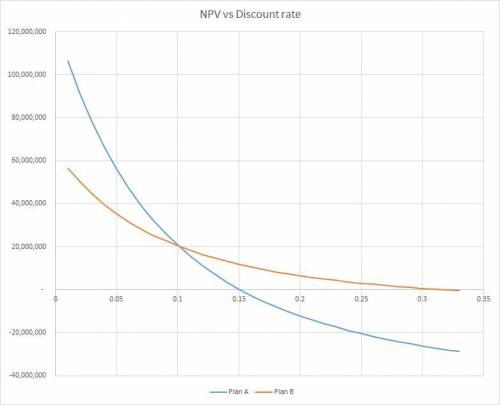

The Pinkerton Publishing Company is considering two mutually exclusive expansion plans. Plan A calls for the expenditure of $56 million on a large-scale, integrated plant that will provide an expected cash flow stream of $9 million per year for 20 years. Plan B calls for the expenditure of $12 million to build a somewhat less efficient, more labor-intensive plant that has an expected cash flow stream of $3.8 million per year for 20 years. The firm's cost of capital is 11%.

Calculate each project's NPV. Round your answers to the nearest dollar.

Calculate each project's IRR. Round your answers to two decimal places.

Set up a Project

Δ

by showing the cash flows that will exist if the firm goes with the large plant rather than the smaller plant.

Year 0

Years 1-20

What is the NPV for this Project

Δ

? Round your answer to the nearest dollar.

What is the IRR for this Project

Δ

? Round your answer to two decimal places.

Answers: 3

Another question on Business

Business, 22.06.2019 11:50

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i.e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i.e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

Business, 22.06.2019 12:10

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

You know the right answer?

The Pinkerton Publishing Company is considering two mutually exclusive expansion plans. Plan A calls...

Questions

Mathematics, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

History, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

English, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

World Languages, 09.09.2020 06:01

Chemistry, 09.09.2020 06:01

History, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

English, 09.09.2020 06:01

English, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

Mathematics, 09.09.2020 06:01

History, 09.09.2020 06:01

![NPV_A=-I_0+\sum_{k=1}^{20} (CF_k)(1+i)^{-k}\\\\NPV_A=-I_0+(CF)[\frac{1-(1+i)^{-20}}{i}] \\\\NPV_A=-56+9*[\frac{1-(1.11)^{-20}}{0.11}]=-56+9*\frac{0.876}{0.11}=-56+9*7.963328117 \\\\NPV_A=-56+71.66995306= 15.669953](/tpl/images/0582/1582/55547.png)

![NPV_B=-I_0+\sum_{k=1}^{20} (CF_k)(1+i)^{-k}\\\\NPV_B=-I_0+(CF)[\frac{1-(1+i)^{-20}}{i}] \\\\NPV_B=-12+3.8*[\frac{1-(1.11)^{-20}}{0.11}]=-12+3.8*\frac{0.876}{0.11}=-12+3.8*7.963328117\\\\NPV_B=-12+30.26064685=18.260647](/tpl/images/0582/1582/965fc.png)