Business, 02.04.2020 05:05 Mariela2699

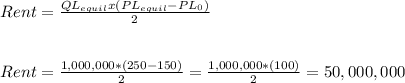

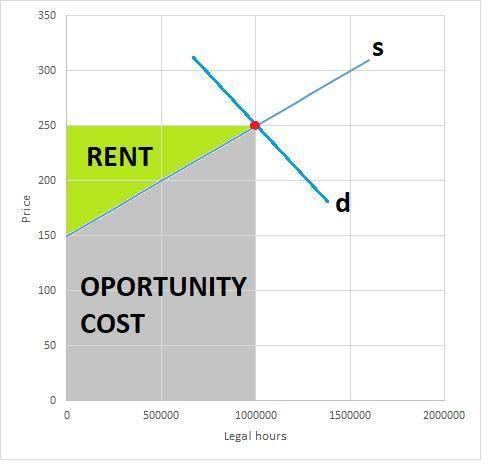

Suppose the local market for legal services has an upward sloping supply curve, PL = 150 +0.0001QL where PL is the price of legal services and QL is the number of hours of legalservices. If the equilibrium price of legal services is $250 per hour, what is the aggregateeconomic rent earned by lawyers in this market?

A) $50,000

B) $1,000,000

C) $50,000,000

D) $100,000,000

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Which of the following is a disadvantage to choosing a sole proprietorship business structure? question 9 options: the owner has personal responsibility for the company's liabilities. the owner has to share the profits with partners. the owner is still liable for personal debts. the owner has to report to shareholders.

Answers: 1

Business, 22.06.2019 01:30

Standardization is associated with which of the following management orientations? a) ethnocentric orientation b) polycentric orientation c) regiocentric orientation d) geocentric orientation

Answers: 1

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 08:30

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

You know the right answer?

Suppose the local market for legal services has an upward sloping supply curve, PL = 150 +0.0001QL w...

Questions

Computers and Technology, 27.09.2019 13:30

Mathematics, 27.09.2019 13:30

Mathematics, 27.09.2019 13:30

Computers and Technology, 27.09.2019 13:30

Mathematics, 27.09.2019 13:30

Social Studies, 27.09.2019 13:30

Biology, 27.09.2019 13:30

Computers and Technology, 27.09.2019 13:30

Mathematics, 27.09.2019 13:30

Biology, 27.09.2019 13:30

Mathematics, 27.09.2019 13:30

History, 27.09.2019 13:30

Mathematics, 27.09.2019 13:30