Business, 27.03.2020 18:06 ryanbasdao

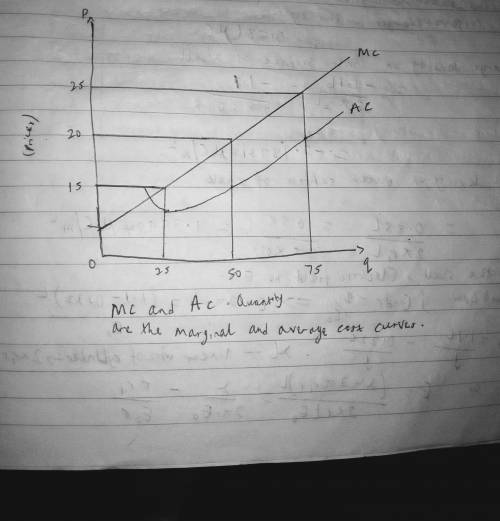

The town where Beth’s Lawn Mowing Service is located (see Problems 8.1 and 8.2) is subject to sporadic droughts and monsoons. During periods of drought, the price for mowing lawns drops to $15 per acre, whereas during monsoons, it rises to $25 per acre.

a. How will Beth react to these changing prices?

b. Suppose that weeks of drought and weeks of monsoons each occur half the time during a summer. What will Beth’s average weekly profit be?

c. Suppose Beth’s kindly (but still greedy) father offers to eliminate the uncertainty in Beth’s profits by agreeing to trade her the weekly profits

Answers: 3

Another question on Business

Business, 21.06.2019 22:50

He taylor company sells music systems. each music system costs the company $100 and will be sold to the public for $250. in year one, the company sells 100 gift cards to customers for $250 each ($25,000 in total). these cards are valid for just one year, and company officials expect them to all be redeemed. in year two, only 96 of the cards are returned. what amount of net income does the company report for year two in connection with these cards? a. $15,000b. $15,400c. $15,500d. $15,800

Answers: 1

Business, 21.06.2019 23:00

Which of the following statements is correct? large corporations are taxed more favorably than sole proprietorships. corporate stockholders are exposed to unlimited liability. due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of u.s. businesses (in terms of number of businesses) are organized as corporations. most businesses (by number and total dollar sales) are organized as partnerships or proprietorships because it is easier to set up and operate in one of these forms rather than as a corporation. however, if the business gets very large, it becomes advantageous to convert to a corporation, mainly because corporations have important tax advantages over proprietorships and partnerships. most business (measured by dollar sales) is conducted by corporations in spite of large corporations’ often less favorable tax treatment, due to legal considerations related to ownership transfers and limited liability.

Answers: 3

Business, 22.06.2019 09:50

Acar manufacturer uses new machines that automatically assemble an engine from parts fed to the system. the machine can regulate the speed ofassembly depending on the number of parts produced. which type of technology does this machine use? angenoem mense wat ons in matin en esta va ser elthe machine uses

Answers: 3

Business, 22.06.2019 10:30

Issued to the joint planning and execution community (jpec) initiates the development of coas; it also requests that the supported ccdr submit a commander's estimate of the situation with a recommended coa to resolve the situation (joint force command and staff participation in the joint operation planning and execution system, page 10)

Answers: 2

You know the right answer?

The town where Beth’s Lawn Mowing Service is located (see Problems 8.1 and 8.2) is subject to sporad...

Questions

English, 24.09.2021 14:00

Biology, 24.09.2021 14:00

Mathematics, 24.09.2021 14:00

Advanced Placement (AP), 24.09.2021 14:00

Mathematics, 24.09.2021 14:00

English, 24.09.2021 14:00

Mathematics, 24.09.2021 14:00

Mathematics, 24.09.2021 14:00

History, 24.09.2021 14:00

English, 24.09.2021 14:00