Business, 26.03.2020 20:29 Lpryor8465

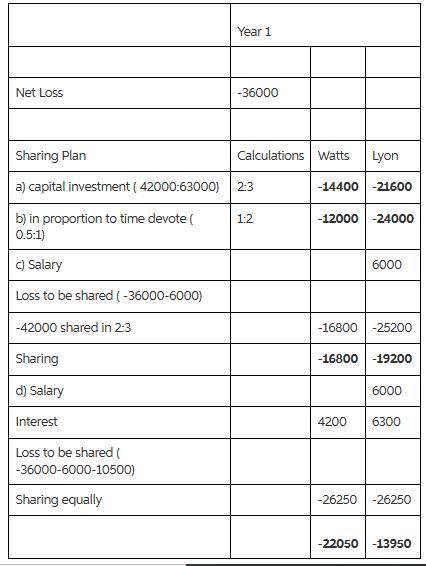

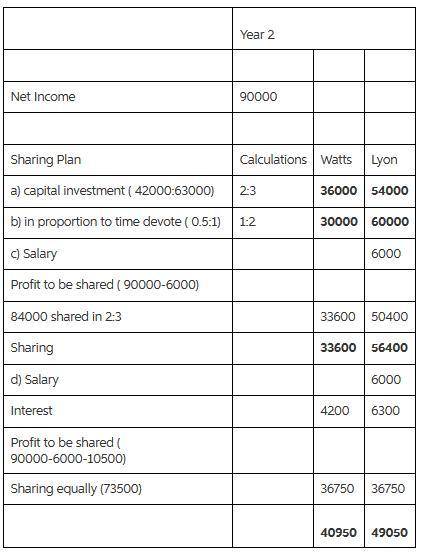

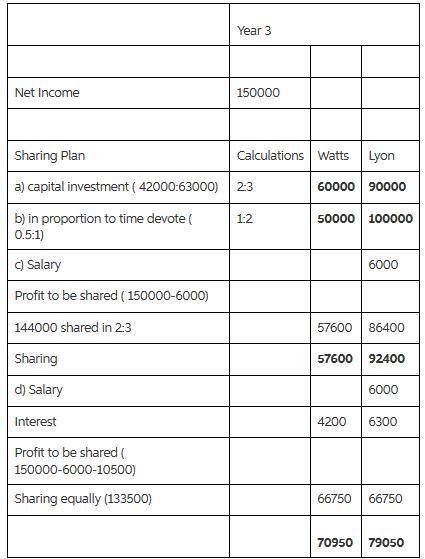

Watts and Lyon are forming a partnership. Watts invests $42,000 and Lyon invests $63,000. The partners agree that Watts will work one-third of the total time devoted to the partnership and Lyon will work two-thirds. They have discussed the following alternative plans for sharing income and loss: (a) in the ratio of their initial capital investments; (b) in proportion to the time devoted to the business; (c) a salary allowance of $72,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments; or (d) a salary allowance of $72,000 per year to Lyon, 10% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $36,000 net loss; Year 2, $90,000 net income; and Year 3, $150,000 net income.

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

What is the opportunity cost (in civilian output) of a defense buildup that raises military spending from 4.0 to 4.3 percent of an $18 trillion economy? instructions: enter your response rounded to the nearest whole number?

Answers: 3

Business, 22.06.2019 08:30

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 23:30

Miller company’s most recent contribution format income statement is shown below: total per unit sales (20,000 units) $300,000 $15.00 variable expenses 180,000 9.00 contribution margin 120,000 $6.00 fixed expenses 70,000 net operating income $ 50,000 required: prepare a new contribution format income statement under each of the following conditions (consider each case independently): (do not round intermediate calculations. round your "per unit" answers to 2 decimal places.) 1. the number of units sold increases by 15%.

Answers: 1

Business, 23.06.2019 00:30

5. if you were to take a typical payday loan for $150, with an interest rate of 24.5% due in full after two weeks, what is the total amount you would have to repay? a. $186.75 b. $174.50 c. $157.33 d. $153.67

Answers: 1

You know the right answer?

Watts and Lyon are forming a partnership. Watts invests $42,000 and Lyon invests $63,000. The partne...

Questions

Mathematics, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40

History, 12.12.2020 16:40

World Languages, 12.12.2020 16:40

Biology, 12.12.2020 16:40

History, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40

Computers and Technology, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40

Mathematics, 12.12.2020 16:40