Business, 25.03.2020 06:58 dmurdock1973

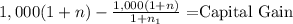

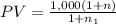

You are considering buying a bond that will be issued today. It will mature in m years. The annual coupon rate is n%. Face value is $1,000. The annual market rate is (n 1)%. a) What is the capital gains yield at exactly a year before the bond matures, when only one coupon and face value are left to be paid, if the market rate stays the same through the years

Answers: 3

Another question on Business

Business, 21.06.2019 16:00

Jelly has joined drakes team drake sends kelly an email explaining details of the project that she will be working on which of these is good etiquette

Answers: 3

Business, 21.06.2019 16:30

Aland development company purchases several acres of land adjacent to a wildlife reserve. it plans to build a new community, complete with shops and schools. green sands, a local environmental group, complains that the company's proposed building methods will disrupt the area's ecological balance. the company wants to respect the local ecology but also wants to build its development. the company decides to schedule a meeting with green sands's representatives to make choices about the property that are agreeable to both sides. which strategy would be most effective in this situation?

Answers: 2

Business, 22.06.2019 08:20

How much does a neurosurgeon can make most in canada? give me answer in candian dollar

Answers: 1

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

You know the right answer?

You are considering buying a bond that will be issued today. It will mature in m years. The annual c...

Questions

Biology, 05.10.2020 15:01

History, 05.10.2020 15:01

Social Studies, 05.10.2020 15:01

English, 05.10.2020 15:01

Mathematics, 05.10.2020 15:01

Mathematics, 05.10.2020 15:01

Mathematics, 05.10.2020 15:01

History, 05.10.2020 15:01

Mathematics, 05.10.2020 15:01

English, 05.10.2020 15:01

Arts, 05.10.2020 15:01

Chemistry, 05.10.2020 15:01