Business, 24.03.2020 23:07 tzartiger12

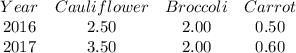

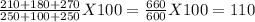

The residents of Vegopia spend all of their income on cauliflower, broccoli, and carrots. In 2016, they spend a total of $250 for 100 heads of cauliflower, $100 for 50 bunches of broccoli, and $250 for 500 carrots. In 2017, they spend a total of $210 for 60 heads of cauliflower, $180 for 90 bunches of broccoli, and $270 for 450 carrots. Complete the following table by calculating the price of one unit of each vegetable in each year. Year Cauliflower Broccoli Carrots 2016 $ $ $ 2017 $ $ $ Using 2016 as the base year, the CPI for 2016 is , and the CPI for 2017 is . The inflation rate in 2017 is % using the CPI.

Answers: 3

Another question on Business

Business, 21.06.2019 19:30

Vulcan company is a monthly depositor whose tax liability for march 2019 is $2,510. 1. what is the due date for the deposit of these taxes? march 17 2. assume that no deposit was made until april 29. compute the following penalties. assume a 365-day year in your computations. round your answers to the nearest cent. a. penalty for failure to make timely deposits. $ b. penalty for failure to fully pay employment taxes $ c. interest on late payment (assume a 5% interest rate). $ d. total penalty imposed $

Answers: 3

Business, 21.06.2019 22:30

Before contacting the news or print media about your business, what must you come up with first ? a. a media expertb. a big budgetc. a track recordd. a story angle

Answers: 1

Business, 21.06.2019 22:50

He taylor company sells music systems. each music system costs the company $100 and will be sold to the public for $250. in year one, the company sells 100 gift cards to customers for $250 each ($25,000 in total). these cards are valid for just one year, and company officials expect them to all be redeemed. in year two, only 96 of the cards are returned. what amount of net income does the company report for year two in connection with these cards? a. $15,000b. $15,400c. $15,500d. $15,800

Answers: 1

Business, 22.06.2019 07:50

Connors academy reported inventory in the 2017 year-end balance sheet, using the fifo method, as $154,000. in 2018, the company decided to change its inventory method to lifo. if the company had used the lifo method in 2017, the company estimates that ending inventory would have been in the range $130,000-$135,000. what adjustment would connors make for this change in inventory method?

Answers: 1

You know the right answer?

The residents of Vegopia spend all of their income on cauliflower, broccoli, and carrots. In 2016, t...

Questions

English, 11.10.2019 20:30

Mathematics, 11.10.2019 20:30

Mathematics, 11.10.2019 20:30

Mathematics, 11.10.2019 20:30

Mathematics, 11.10.2019 20:30

Mathematics, 11.10.2019 20:30

Biology, 11.10.2019 20:30

= 10%.

= 10%.