Business, 24.03.2020 21:15 bartam833oz4qy6

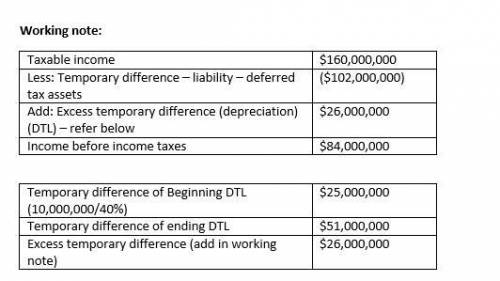

James McDowell Co. establishes a $102,000,000 liability at the end of 2020 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2021. Also, at the end of 2020, the company has $51,000,000 of temporary differences due to excess depreciation for tax purposes, $7 million of which will reverse in 2018. The enacted tax rate for all years is 40%, and the company pays taxes of $160 million of taxable income in 2017. McDowell expects to have taxable inome in 2018.

a. Determine the deferred taxes to be reported at the end of 2017.

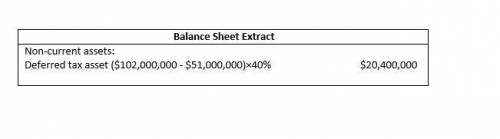

b. Indicate how the deferred taxes computed in (a) are to be reported on the balance sheet.

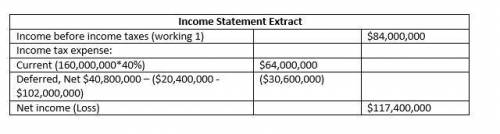

c. Assuming that the only deferred tax account at the beginning of 2017 was a deferred tax liability of $10,000,000, draft the income tax expense portion of the income statement for 2017, beginning with the line "Inconme before income taxes."

Answers: 3

Another question on Business

Business, 22.06.2019 19:30

About 20 years ago, sturdy light, inc., produced a sturdy, lightweight backpack in a market that was rapidly growing. sturdy light became a leader in this market. eventually, the backpack market reached the maturity stage and slowed down. however, by this time, sturdy light had developed a strong brand name and continued to steadily lead the market. which of the following describes this scenario? a. sturdy light was a star that developed into a cash cow. b. sturdy light was a question mark that developed into a star. c. sturdy light was a dog that developed into a question mark. d. sturdy light was a cash cow that developed into a star.

Answers: 2

Business, 22.06.2019 21:00

There is just one person in our group, silvia, who seems to have radically different ideas about how to complete our project. she seems to purposely disagree with the majority opinions of the rest of us though yesterday she said something that made a lot of sense to us solve our production problem. i suggested to the entire group today that we hear silvia’s suggestions and asked silvia to share in-depth more of what she said yesterday. i am using which adaptive leader behavior?

Answers: 2

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

Business, 22.06.2019 23:00

Which completes the equation? o + a + consideration (+ = k legal capacity legal capability legal injunction legal corporation

Answers: 1

You know the right answer?

James McDowell Co. establishes a $102,000,000 liability at the end of 2020 for the estimated site-cl...

Questions

Mathematics, 18.07.2019 04:30

English, 18.07.2019 04:30

Health, 18.07.2019 04:30

Mathematics, 18.07.2019 04:30

Advanced Placement (AP), 18.07.2019 04:30

Biology, 18.07.2019 04:30

Mathematics, 18.07.2019 04:30

History, 18.07.2019 04:30

Advanced Placement (AP), 18.07.2019 04:30

Mathematics, 18.07.2019 04:30