Business, 23.03.2020 17:29 joseaguilaroux4zh

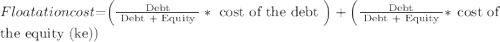

Suppose your company needs $18 million to build a new assembly line. Your target debt-equity ratio is .8. The flotation cost for new equity is 11 percent, but the flotation cost for debt is only 8 percent. Your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small. a.What is your company’s weighted average flotation cost, assuming all equity is raised externally? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)b. What is the true cost of building the new assembly line after taking flotation costs into account? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole dollar amount, e. g., 1,234,5667.)

Answers: 2

Another question on Business

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 11:30

Amano s preguntes cationing to come fonds and consumer good 8. why did the u.s. government use rationing for some foods and consumer goods during world war ii?

Answers: 1

Business, 22.06.2019 12:00

In mexico, many garment or sewing shops found they could entice many young people to work for them if they offered clean, air conditioned work areas with high-quality locker rooms to clean up in after the work day. typically, traditional garment shops had to offer to get workers to apply for the hard, repetitive, and somewhat dangerous work. a. benchmark competitive wages b.compensating differentials c. monopoly wages d. wages based on human capital development of each employee

Answers: 3

Business, 22.06.2019 23:50

Melissa buys an iphone for $240 and gets consumer surplus of $160. a. what is her willingness to pay? b. if she had bought the iphone on sale for $180, what would her consumer surplus have been?

Answers: 3

You know the right answer?

Suppose your company needs $18 million to build a new assembly line. Your target debt-equity ratio i...

Questions

Mathematics, 05.02.2021 19:00

Mathematics, 05.02.2021 19:00

Mathematics, 05.02.2021 19:00

SAT, 05.02.2021 19:00

Mathematics, 05.02.2021 19:00

Advanced Placement (AP), 05.02.2021 19:00

Health, 05.02.2021 19:00

Social Studies, 05.02.2021 19:00

Social Studies, 05.02.2021 19:00