Suppose we are planning to buy a company with the following forecasts:

Year 1 2 3 &...

Business, 20.03.2020 09:11 lisacarter0804

Suppose we are planning to buy a company with the following forecasts:

Year 1 2 3 & afterwards

FCF $5 million $ 5.5 million 3% constant growth rate

Debt level $50 million $35 million Constant debt to equity ratio. Capital will be 50% debt and 50% equity, wd = ws = 0.5.

The cost of debt is 5%

The cost of equity is 20%

The tax rate is 40%

The company has 15 million shares outstanding

The current stock price is $2.05

The company is currently holding no financial assets.

The company has $3,000,000 in debt.

WACC, the cost of capital, is equal to 11.5%

RSU, the cost of unlevered equity, is equal to 12.5%

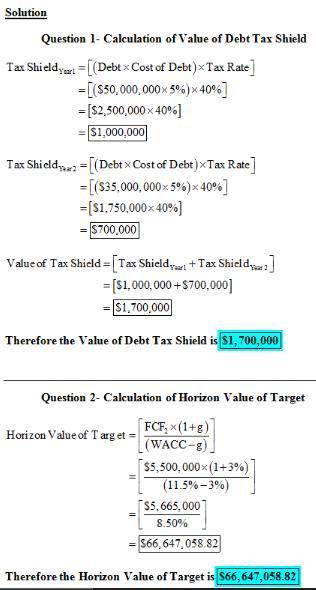

a. Calculate the value of the debt tax shield.

b. Calculate the horizon value of the target.

Answers: 3

Another question on Business

Business, 21.06.2019 21:30

In its 2016 annual report, caterpillar inc. reported the following (in millions): 2016 2015 sales $38,537 $47,011 cost of goods sold 28,309 33,546 as a percentage of sales, did caterpillar's gross profit increase or decrease during 2016? select one: a. gross profit increased from 26.8% to 28.6% b. gross profit decreased from 28.6% to 26.5% c. gross profit increased from 71.4% to 73.2% d. gross profit decreased from 73.2% to 71.4% e. there is not enough information to answer the question.

Answers: 2

Business, 22.06.2019 11:30

You've arrived at the pecan shellers conference—your first networking opportunity. naturally, you're feeling nervous, but to avoid seeming insecure or uncertain, you've decided to a. speak a little louder than you would normally. b. talk on your cell phone as you walk around. c. hold an empowered image of yourself in your mind. d. square your shoulders before entering the room.

Answers: 2

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

Business, 22.06.2019 20:00

Afirm is producing at minimum average total cost with its current plant. draw the firm's long-run average cost curve. label it. draw a point on the lrac curve at which the firm cannot lower its average total cost. draw the firm's short-run average total cost curve that is consistent with the point you have drawn. label it.g

Answers: 2

You know the right answer?

Questions

Mathematics, 09.06.2021 18:20

Mathematics, 09.06.2021 18:20

Mathematics, 09.06.2021 18:20

Mathematics, 09.06.2021 18:20

Mathematics, 09.06.2021 18:20

Mathematics, 09.06.2021 18:20

Mathematics, 09.06.2021 18:30

Mathematics, 09.06.2021 18:30

Mathematics, 09.06.2021 18:30

Chemistry, 09.06.2021 18:30

Mathematics, 09.06.2021 18:30

Business, 09.06.2021 18:30

Mathematics, 09.06.2021 18:30