Business, 18.03.2020 18:19 richdakid26

John (age 59 and single) has earned income of $4,200. He has $36,700 of unearned (capital gain) income.

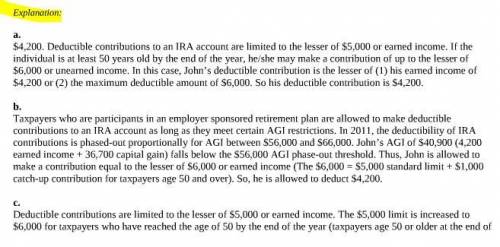

a. If he does not participate in an employer-sponsored plan, what is the maximum deductible IRA contribution John can make in 2013?

b. If he does participate in an employer-sponsored plan, what is the maximum deductible IRA contribution John can make in 2013?

c. If he does not participate in an employer-sponsored plan, what is the maximum deductible IRA contribution John can make in 2019 if he has earned income of $19,200?

Answers: 3

Another question on Business

Business, 21.06.2019 19:40

Michigan mattress company is considering the purchase of land and the construction of a new plant. the land, which would be bought immediately (at t = 0), has a cost of $100,000 and the building, which would be erected at the end of the first year (t = 1), would cost $500,000. it is estimated that the firm's afterminustax cash flow will increase by $100,000 starting at the end of the second year, and that this incremental flow would increase at a 10 percent rate annually over the next 10 years. what is the approximate payback period?

Answers: 3

Business, 21.06.2019 20:30

If temper company, a manufacturer of mattresses, was considering moving its production facilities to china but decided against it because the additional costs of shipping the mattresses back to the u.s. would offset the cost savings associated with moving the production facilities, the increased costs associated with shipping would be an example ofanswers: learning-curve economies.diseconomies of scale.economies of scale.competitive advantages.

Answers: 2

Business, 22.06.2019 05:00

Xie company identified the following activities, costs, and activity drivers for 2017. the company manufactures two types of go-karts: deluxe and basic. activity expected costs expected activity handling materials $ 625,000 100,000 parts inspecting product 900,000 1,500 batches processing purchase orders 105,000 700 orders paying suppliers 175,000 500 invoices insuring the factory 300,000 40,000 square feet designing packaging 75,000 2 models required: 1. compute a single plantwide overhead rate, assuming that the company assigns overhead based on 125,000 budgeted direct labor hours. 2. in january 2017, the deluxe model required 2,500 direct labor hours and the basic model required 6,000 direct labor hours. assign overhead costs to each model using the single plantwide overhead rate.

Answers: 3

Business, 22.06.2019 11:00

Aprofessional does specialized work that's primarily: degree based. medical or legal. well paying. intellectual and creative

Answers: 2

You know the right answer?

John (age 59 and single) has earned income of $4,200. He has $36,700 of unearned (capital gain) inco...

Questions

English, 11.09.2019 22:30

Mathematics, 11.09.2019 22:30

Mathematics, 11.09.2019 22:30

Medicine, 11.09.2019 22:30

Mathematics, 11.09.2019 22:30

History, 11.09.2019 22:30

Mathematics, 11.09.2019 22:30

Computers and Technology, 11.09.2019 22:30

History, 11.09.2019 22:30

Mathematics, 11.09.2019 22:30

Mathematics, 11.09.2019 22:30