Business, 17.03.2020 04:38 loredobrooke5245

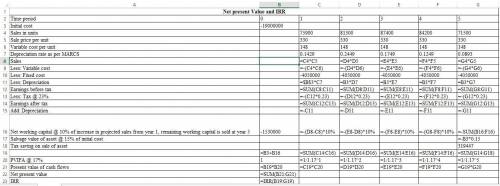

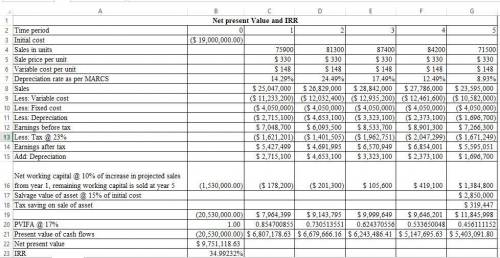

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Year Unit Sales 1 75,900 2 81,300 3 87,400 4 84,200 5 71,500 Production of the implants will require $1,530,000 in net working capital to start and additional net working capital investments each year equal to 10 percent of the projected sales increase for the following year. Total fixed costs are $4,050,000 per year, variable production costs are $148 per unit, and the units are priced at $330 each. The equipment needed to begin production has an installed cost of $19,000,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as 7-year MACRS property. In five years, this equipment can be sold for about 15 percent of its acquisition cost. The company is in the 23 percent marginal tax bracket and has a required return on all its projects of 17 percent. MACRS schedule. What is the NPV of the project?What is the IRR of the project?

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

The law says your employer is responsible for providing you with a safe and healthy workplace. true or false?

Answers: 1

Business, 22.06.2019 11:00

Aprofessional does specialized work that's primarily: degree based. medical or legal. well paying. intellectual and creative

Answers: 2

Business, 22.06.2019 13:30

You operate a small advertising agency. you employ two secretaries, a graphic designer, three sales representatives, and an office coordinator. 1. what types of things would you consider when determining how to compensate each position? describe two (2) considerations. 2. what type of compensation plan would you use for each position?

Answers: 1

Business, 22.06.2019 14:20

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

You know the right answer?

Aday Acoustics, Inc., projects unit sales for a new 7-octave voice emulation implant as follows: Yea...

Questions

Mathematics, 14.11.2020 01:20

English, 14.11.2020 01:20

History, 14.11.2020 01:20

History, 14.11.2020 01:20

Mathematics, 14.11.2020 01:20

Chemistry, 14.11.2020 01:20

Mathematics, 14.11.2020 01:20

Social Studies, 14.11.2020 01:20

Mathematics, 14.11.2020 01:20

Social Studies, 14.11.2020 01:20

Mathematics, 14.11.2020 01:20

Biology, 14.11.2020 01:20

Computers and Technology, 14.11.2020 01:20