Business, 17.03.2020 04:43 cathhgc95791

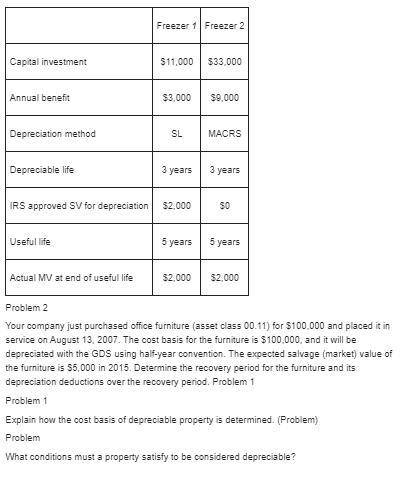

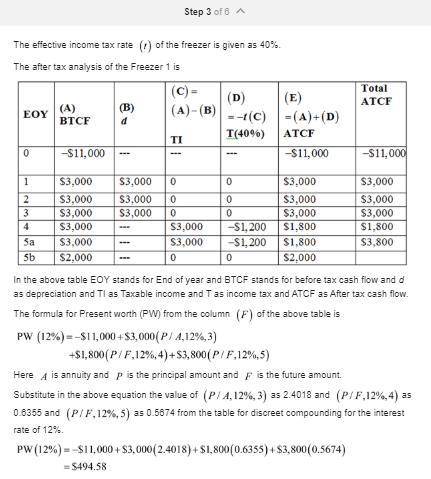

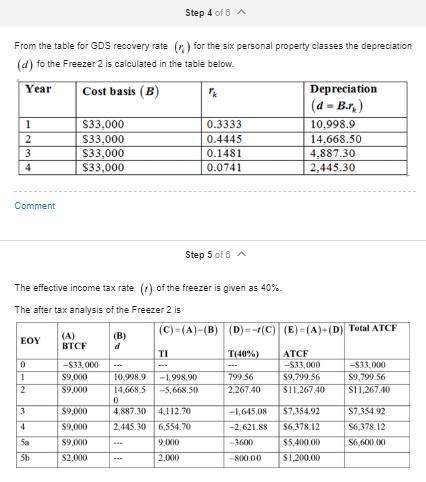

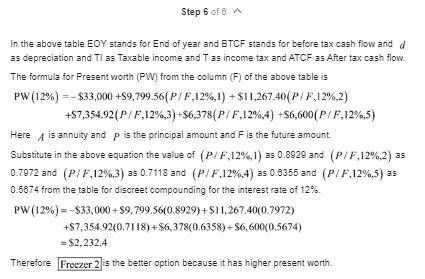

A biotech company has an effective income tax rate of 40%. Recaptured depreciation is also taxed at the rate of 40%. The company must choose one of the following mutually exclusive cryogenic freezers for its tissue samples. The after-tax MARR is 12% per year. Which freezer should be selected based on after-tax present worth?

Answers: 1

Another question on Business

Business, 21.06.2019 17:00

Which basic economic questions deals with the issue of how the incomeof people in various occupations is determined

Answers: 1

Business, 21.06.2019 19:40

Uppose stanley's office supply purchases 50,000 boxes of pens every year. ordering costs are $100 per order and carrying costs are $0.40 per box. moreover, management has determined that the eoq is 5,000 boxes. the vendor now offers a quantity discount of $0.20 per box if the company buys pens in order sizes of 10,000 boxes. determine the before-tax benefit or loss of accepting the quantity discount. (assume the carrying cost remains at $0.40 per box whether or not the discount is taken.)

Answers: 1

Business, 22.06.2019 01:00

The penalties for a first-time dui charge include revocation of drivers license a. 180 days b. ben 180 des and one year c. bence 90 and 180 d. one year

Answers: 2

You know the right answer?

A biotech company has an effective income tax rate of 40%. Recaptured depreciation is also taxed at...

Questions

Mathematics, 13.11.2019 04:31

Mathematics, 13.11.2019 04:31

Biology, 13.11.2019 04:31

Mathematics, 13.11.2019 04:31

Mathematics, 13.11.2019 04:31

Mathematics, 13.11.2019 04:31

Mathematics, 13.11.2019 04:31

English, 13.11.2019 04:31

Business, 13.11.2019 04:31