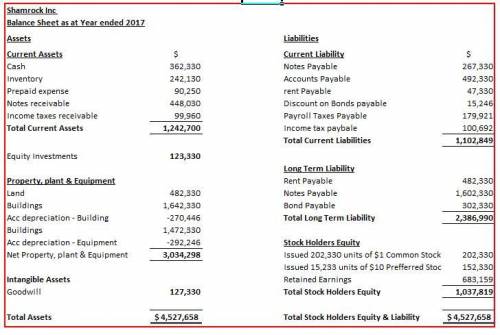

Presented below are a number of balance sheet items for Shamrock, Inc., for the current year, 2017.

Goodwill $127,330 Accumulated Depreciation-Equipment $292,246

Payroll Taxes Payable 179,921 Inventory 242,130

Bonds payable 302,330 Rent payable (short-term) 47,330

Discount on bonds payable 15,246 Income taxes payable 100,692

Cash 362,330 Rent payable (long-term) 482,330

Land 482,330 Common stock, $1 par value 202,330

Notes receivable 448,030 Preferred stock, $10 par value 152,330

Notes payable (to banks) 267,330 Prepaid expenses 90,250

Accounts payable 492,330 Equipment 1,472,330

Retained earnings ? Equity investments (trading) 123,330

Income taxes receivable 99,960 Accumulated Depreciation-Buildings 270,446

Notes payable (long-term) 1,602,330 Buildings 1,642,330

Required:

Prepare a classified balance sheet in good form. Common stock authorized was 400,000 shares, and preferred stock authorized was 20,000 shares. Assume that notes receivable and notes payable are short-term, unless stated otherwise. Cost and fair value of equity investments (trading) are the same. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Building and Equipment.)

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Do you think a travel organization company might be able to get less expensive airline tickets then you as an individual could get? (no less then 25 words)

Answers: 1

Business, 22.06.2019 15:10

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 22.06.2019 19:00

Question 55 ted, a supervisor for jack's pool supplies, was accused of stealing pool supplies and selling them to friends and relatives at reduced prices. given ted's earlier track record, he was not fired immediately. the authorities decided to give him an administrative leave, without pay, until the investigation was complete. in view of the given information, it would be most appropriate to say that ted was: demoted. discharged. suspended. dismissed.

Answers: 2

Business, 23.06.2019 01:30

Akika corporation started as a small firm and has grown substantially in the past decade. its interests span from electronics to real estate and aviation. akika's board of directors have now decided to create independent business units for and categorize the actions performed under each domain. each business unit will have distinct roles and responsibilities. which of the 14 principles of fayol does this exemplify?

Answers: 3

You know the right answer?

Presented below are a number of balance sheet items for Shamrock, Inc., for the current year, 2017.<...

Questions

Biology, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

English, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

English, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

English, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Health, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01