Business, 16.03.2020 22:31 briyantesol

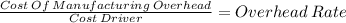

Aspen Company estimates its manufacturing overhead to be $515,000 and its direct labor costs to be $515,000 for year 2. Aspen worked on three jobs for the year. Job 2-1, which was sold during year 2, had actual direct labor costs of $221,400. Job 2-2, which was completed, but not sold at the end of the year, had actual direct labor costs of $459,200. Job 2-3, which is still in work-in-process inventory, had actual direct labor costs of $139,400. Actual manufacturing overhead for year 2 was $805,900. Manufacturing overhead is applied on the basis of direct labor costs. Required: Prepare an entry to allocate over- or underapplied overhead to Work in Process, Finished Goods and Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Answers: 3

Another question on Business

Business, 22.06.2019 02:40

The following accounts are denominated in pesos as of december 31, 2015. for reporting purposes, these amounts need to be stated in u.s. dollars. for each balance, indicate the exchange rate that would be used if a translation is made under the current rate method. then, again for each account, provide the exchange rate that would be necessary if a remeasurement is being made using the temporal method. the company was started in 2000. the buildings were acquired in 2002 and the patents in 2003. (round your answers to 2 decimal places.) exchange rates for 1 peso are as follows: 2000 1 peso = $ 0.28 2002 1 = 0.26 2003 1 = 0.25 january 1, 2015 1 = 0.24 april 1, 2015 1 = 0.23 july 1, 2015 1 = 0.22 october 1, 2015 1 = 0.20 december 31, 2015 1 = 0.16 average for 2015 1 = 0.19

Answers: 3

Business, 22.06.2019 22:10

Afirm plans to begin production of a new small appliance. the manager must decide whether to purchase the motors for the appliance from a vendor at $10 each or to produce them in-house. either of two processes could be used for in-house production; process a would have an annual fixed cost of $200,000 and a variable cost of $7 per unit, and process b would have an annual fixed cost of $175,000 and a variable cost of $8 per unit. determine the range of annual volume for which each of the alternatives would be best. (round your first answer to the nearest whole number. include the indifference value itself in this answer.)

Answers: 2

Business, 23.06.2019 02:30

The accountant at bramble corp. has determined that income before income taxes amounted to $10800 using the fifo costing assumption. if the income tax rate is 30% and the amount of income taxes paid would be $900 greater if the lifo assumption were used, what would be the amount of income before taxes under the lifo assumption?

Answers: 2

Business, 23.06.2019 12:50

Delux technology has a reputation of reliability and a winning customer service, qualities that to build this highly respected name brand over the last 15 years. speaking at a recent business conference, steve, the ceo of delux, told his audience, "we have built our reputation by changing little over the last several years, but consistently customers with great, caring service and a reliable product." which type of strategy does delux technology use? a.) growth strategy b.) defensive strategy c.) retrenchment strategy d.) merger approach e.) stability strategy

Answers: 1

You know the right answer?

Aspen Company estimates its manufacturing overhead to be $515,000 and its direct labor costs to be $...

Questions

Mathematics, 19.08.2019 09:00

Mathematics, 19.08.2019 09:00

Social Studies, 19.08.2019 09:00

Mathematics, 19.08.2019 09:00

History, 19.08.2019 09:00

Mathematics, 19.08.2019 09:00

History, 19.08.2019 09:00

Mathematics, 19.08.2019 09:00

Mathematics, 19.08.2019 09:00

English, 19.08.2019 09:00

Mathematics, 19.08.2019 09:00

Mathematics, 19.08.2019 09:00

Physics, 19.08.2019 09:00

![\left[\begin{array}{cccc}Item&Value&Weight&Allocated\\COGS&221400&0.27&3807\\FG&459200&0.56&7896\\WIP&139400&0.17&2397\\&&&\\Total&820000&1&14100\\\end{array}\right]](/tpl/images/0549/4102/772ae.png)