Business, 16.03.2020 21:50 edeliz2804

You own a big rental car company in Indianapolis and maintain a fleet of 50 SUVs. Customers make their rental car reservations using an app before they arrive the location, and therefore, as long as a car is available in the lot they directly proceed to the car assigned them through the app for pick up. If all SUVs are rented, your customers are willing to wait until one is available. The average time between requests for an SUV is 2.5 hours, with a standard deviation of 2.5 hours. The arrival pattern remains to be consistent throughout the day (24 hrs). An SUV is rented, on average, for 4 days with a standard deviation of 1 day.

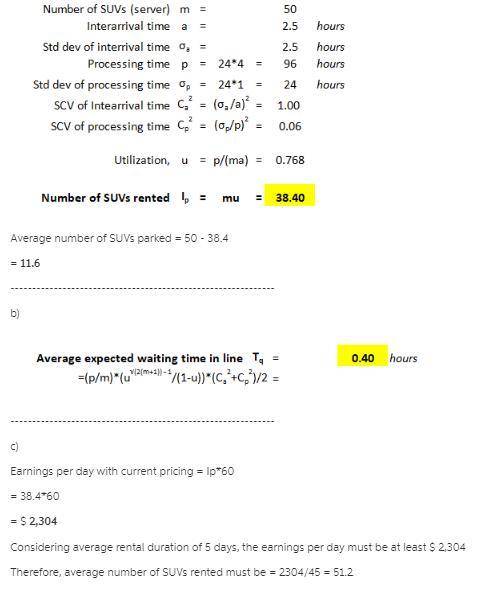

a) At any given time, what is the average number of SUVs parked in your company's lot? (Hint: you need to find the average number of SUVs rented and then subtract this number from the fleet size, i. e., 50. Make sure the time units match in your calculations.).

b) What is the average time a customer has to wait before getting a rental SUV (in (mins])?

c) ** You make a marketing survey and find that if you reduce daily rental price from $60 to $45, the average rental duration would become 5 days. What is the minimum demand rate [customers/day) that would justify the price decrease? (Assume that Va and CVp do not change). (Hint: You need to find how much you would make per day with the current pricing, i. e., Ip*$60/day, let's call it X for now. Then find how much you would make under the new pricing as a function of interarrival time [here, remember that rental duration changes). Then solve for the interarrival that gives a profit at least as high as X. Use this inter-arrival time you found to calculate the demand rate).

d) You are considering making a change on rental policy by limiting all SUV rentals to exactly 4 days. If you impose this restriction, the average interarrival time will go up to 3 hours and the standard deviation will become 3 hours. What would the waiting time be after this change in rental policy?

Answers: 2

Another question on Business

Business, 21.06.2019 15:00

In its first year of operations, crane company recognized $31,700 in service revenue, $7,700 of which was on account and still outstanding at year-end. the remaining $24,000 was received in cash from customers. the company incurred operating expenses of $16,600. of these expenses, $12,690 were paid in cash; $3,910 was still owed on account at year-end. in addition, crane prepaid $3,260 for insurance coverage that would not be used until the second year of operations.

Answers: 3

Business, 22.06.2019 00:00

1tanner invested $135,000 cash along with office equipment valued at $32,400 in the company in exchange for common stock. 2 the company prepaid $7,200 cash for 12 months’ rent for office space. (hint: debit prepaid rent for $7,200.) 3 the company made credit purchases for $16,200 in office equipment and $3,240 in office supplies. payment is due within 10 days. 6 the company completed services for a client and immediately received $2,000 cash. 9 the company completed a $10,800 project for a client, who must pay within 30 days. 13 the company paid $19,440 cash to settle the account payable created on april 3. 19 the company paid $6,000 cash for the premium on a 12-month insurance policy. (hint: debit prepaid insurance for $6,000.) 22 the company received $8,640 cash as partial payment for the work completed on april 9. 25 the company completed work for another client for $2,640 on credit. 28 the company paid $6,200 cash in dividends. 29 the company purchased $1,080 of additional office supplies on credit. 30 the company paid $700 cash for this month’s utility bill. prepare general journal entries to record these transactions. 2. post the journal entries from part 1 to the ledger accounts.

Answers: 2

Business, 22.06.2019 11:00

What is the correct percentage of texas teachers charged with ethics violations each year?

Answers: 2

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

You know the right answer?

You own a big rental car company in Indianapolis and maintain a fleet of 50 SUVs. Customers make the...

Questions

Mathematics, 09.10.2021 01:30

Mathematics, 09.10.2021 01:30

SAT, 09.10.2021 01:30

History, 09.10.2021 01:30

Mathematics, 09.10.2021 01:30

History, 09.10.2021 01:30

Mathematics, 09.10.2021 01:30

English, 09.10.2021 01:30

Geography, 09.10.2021 01:30

Mathematics, 09.10.2021 01:30

Mathematics, 09.10.2021 01:30