Business, 16.03.2020 21:30 travorissteele822

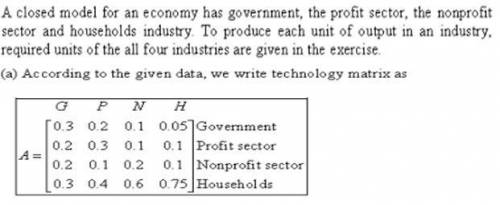

The following problem refers to a closed Leontief model. A closed model for an economy identifies government, the profit sector, the nonprofit sector, and households as its industries. Each unit of government output requires 0.3 unit of government input, 0.2 unit of profit sector input, 0.2 unit of nonprofit sector input, and 0.3 unit of households input. Each unit of profit sector output requires 0.2 unit of government input, 0.3 unit of profit sector input, 0.1 unit of nonprofit sector input, and 0.4 unit of households input. Each unit of nonprofit sector output requires 0.1 unit of government input, 0.1 unit of profit sector input, 0.2 unit of nonprofit sector input, and 0.6 unit of households input. Each unit of households output requires 0.05 unit of government input, 0.1 unit of profit sector input, 0.1 unit of nonprofit sector input, and 0.75 unit of households input. (a) Write the technology matrix T for this closed model of the economy.

Answers: 2

Another question on Business

Business, 22.06.2019 11:10

Use the information below to answer the following question. the boxwood company sells blankets for $60 each. the following was taken from the inventory records during may. the company had no beginning inventory on may 1. date blankets units cost may 3 purchase 5 $20 10 sale 3 17 purchase 10 $24 20 sale 6 23 sale 3 30 purchase 10 $30 assuming that the company uses the perpetual inventory system, determine the gross profit for the month of may using the lifo cost method.

Answers: 1

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

Business, 22.06.2019 13:10

bradford, inc., expects to sell 9,000 ceramic vases for $21 each. direct materials costs are $3, direct manufacturing labor is $12, and manufacturing overhead is $3 per vase. the following inventory levels apply to 2019: beginning inventory ending inventory direct materials 3,000 units 3,000 units work-in-process inventory 0 units 0 units finished goods inventory 300 units 500 units what are the 2019 budgeted production costs for direct materials, direct manufacturing labor, and manufacturing overhead, respectively?

Answers: 2

Business, 22.06.2019 19:30

The owner of firewood to go is considering buying a hydraulic wood splitter which sells for $50,000. he figures it will cost an additional $100 per cord to purchase and split wood with this machine, while he can sell each cord of split wood for $125. if, for this machine, design capacity is 50 cords per day, effective capacity is 40 cords per day, and actual output is expected to be 32 cords per day, what would be its efficiency?

Answers: 1

You know the right answer?

The following problem refers to a closed Leontief model. A closed model for an economy identifies go...

Questions

Mathematics, 14.08.2020 01:01

Business, 14.08.2020 01:01

Social Studies, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01

History, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01

Biology, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01

Mathematics, 14.08.2020 01:01