Answers: 2

Another question on Business

Business, 22.06.2019 05:10

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 10:00

Frolic corporation has budgeted sales and production over the next quarter as follows. the company has 4100 units of product on hand at july 1. 10% of the next months sales in units should be on hand at the end of each month. october sales are expected to be 72000 units. budgeted sales for september would be: july august september sales in units 41,500 53,500 ? production in units 45,700 53,800 58,150

Answers: 3

Business, 22.06.2019 17:50

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Business, 23.06.2019 01:10

Mountain mouse makes freeze-dried meals for hikers. one of mountain mouse's biggest customers is a sporting goods superstore. every 66 days, mountain mouse checks the inventory level at the superstore and places an order to restock the meals. these meals are delivered by ups in 55 days. average demand during the reorder period and order lead time is 8585 meals, and the standard deviation of demand during this same time period is about 1919 meals.calculate the restocking level for mountain mouse. assume that the superstore wants a 95\% service level. what happens to the restocking level if the superstore wants a higher level of service-say, 99]%? the restocking level for the 95% service level is 117 mealssuppose there are 25 meals in the superstore when mountain mouse checks inventory levels. how many meals should be ordered, assuming a 95% service level?

Answers: 3

You know the right answer?

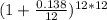

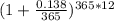

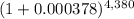

Account A pays 13.8% interest per year. Account B pays 13.5% interest per year, compounded monthly....

Questions

English, 26.02.2021 01:10

Mathematics, 26.02.2021 01:10

Chemistry, 26.02.2021 01:10

Mathematics, 26.02.2021 01:10

Mathematics, 26.02.2021 01:10

Mathematics, 26.02.2021 01:10

English, 26.02.2021 01:10