Business, 12.03.2020 05:14 george27212

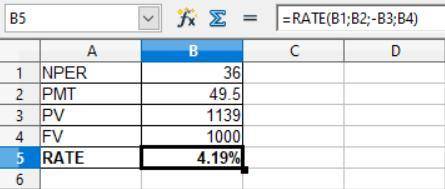

BDJ Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 9.9 percent coupon bonds on the market that sell for $1,139, make semiannual payments, have a par value of $1,000, and mature in 18 years.

Required:

What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not include the percent sign (%). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Answers: 3

Another question on Business

Business, 21.06.2019 19:00

Spirula trading inc sublets a part of its offices building to jade inc. for a period of ten years . where will the company disclose this information?

Answers: 3

Business, 22.06.2019 16:10

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 23.06.2019 04:00

If a transformational leader is supposed to be so smart and visionary, why would he or she emphasize empowerment in his or her leadership approach?

Answers: 3

Business, 23.06.2019 04:00

Asmall company has 10,000 shares. joan owns 200 of these shares. the company decided to split its shares. what is joan's ownership percentage after the split

Answers: 2

You know the right answer?

BDJ Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company curren...

Questions

Business, 04.11.2020 06:20

Mathematics, 04.11.2020 06:20

Mathematics, 04.11.2020 06:20

Social Studies, 04.11.2020 06:20

Mathematics, 04.11.2020 06:20

Mathematics, 04.11.2020 06:20

English, 04.11.2020 06:20

History, 04.11.2020 06:20

Geography, 04.11.2020 06:20