Business, 12.03.2020 03:37 rodrickahammonds

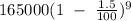

My ferrari 458 is depleting in value and is only worth $165000 in today's market. if the value of the car is steadily depreciating at 3% compounded semi annually, how much will it be worth in 4.5 years

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Case in point 2.4 attaway airlines, part two back at attaway airlines, the morning meeting ended with no agreement between dan esposito and molly kinnon. in fact, a new issue arose. molly now says that the new accounting system is entitled to the highest priority because the federal government soon will require the reporting of certain types of company-paid health insurance premiums. because the current system will not handle this report, she insists that the entire accounting system is a nondiscretionary project. as you might expect, dan is upset. can part of a project be nondiscretionary? what issues need to be discussed? the committee meets again tomorrow, and the members will look to you, as the it director, for guidance.

Answers: 1

Business, 22.06.2019 18:50

Suppose the government enacts a stimulus program composed of $600 billion of new government spending and $300 billion of tax cuts for an economy currently producing a gdp of $14 comma 000 billion. if all of the new spending occurs in the current year and the government expenditure multiplier is 1.5, the expenditure portion of the stimulus package will add nothing percentage points of extra growth to the economy. (round your response to two decimal places.)

Answers: 3

Business, 22.06.2019 21:40

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

Business, 23.06.2019 07:30

Which of the following conditions might result in the best financial decisions? a. agreeableness b. openness c. conscientiousness d. extraversion

Answers: 1

You know the right answer?

My ferrari 458 is depleting in value and is only worth $165000 in today's market. if the value of th...

Questions

Mathematics, 24.01.2021 09:20

Physics, 24.01.2021 09:20

Mathematics, 24.01.2021 09:20

Mathematics, 24.01.2021 09:20

Mathematics, 24.01.2021 09:20

Mathematics, 24.01.2021 09:20

English, 24.01.2021 09:20

Chemistry, 24.01.2021 09:20

Mathematics, 24.01.2021 09:20

Social Studies, 24.01.2021 09:20

Mathematics, 24.01.2021 09:20

Mathematics, 24.01.2021 09:20