Business, 10.03.2020 18:38 cricri2347

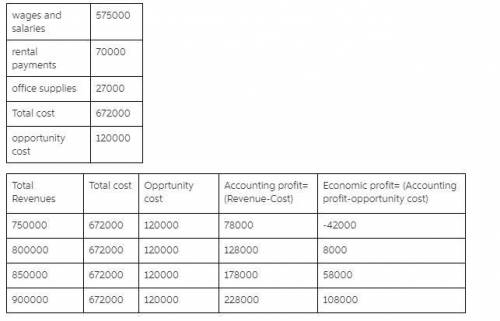

Accounting versus economic profit During a particular year, an advertising firm has the following costs: $575,000 in wages and salaries paid to employees; $70,000 in rental payments for office space; and $27,000 for office supplies, advertising, and utilities. In addition, Susan, the owner of the firm, works for the firm full time (and is not paid a salary, since she gets the firm's profit). If she did not work for the advertising firm, Susan could earn $120,000 per year working as an advertising agent for another firm. For each possible amount of total revenue, fill in the accounting profit and economic profit of the advertising firm. Total Revenue ($) Accounting Profit ($) Economic Profit ($) 750,000 800,000 850,000900,000

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

John f. kennedy believed that a leader should be elected successful a lifelong student in the military

Answers: 3

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

Business, 22.06.2019 14:30

The state in which the manufacturing company you work for is located regulates the presence of a particular substance in the environment to concentrations ≤ x. recently-released, reliable research endorsed by the responsible federal agency conclusively demonstrates that the substance poses no risks at concentrations up to 5x. your company has asked you to consider designing a new process with a waste discharge stream containing up to 2x of the substance. based on the stated conditions, describe this possible.

Answers: 2

Business, 22.06.2019 19:20

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

You know the right answer?

Accounting versus economic profit During a particular year, an advertising firm has the following co...

Questions

History, 27.08.2019 04:00

Chemistry, 27.08.2019 04:00

History, 27.08.2019 04:00

Social Studies, 27.08.2019 04:00

Mathematics, 27.08.2019 04:00

Mathematics, 27.08.2019 04:00

Biology, 27.08.2019 04:00

Chemistry, 27.08.2019 04:00

Mathematics, 27.08.2019 04:00

History, 27.08.2019 04:00

History, 27.08.2019 04:00

Mathematics, 27.08.2019 04:00