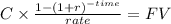

Suppose you are 45 and have a $50,000 face amount, 15-year, limited-payment, participating policy (dividends will be used to build up the cash value of the policy). Your annual premium is $1,000. The cash value of the policy is expected to be $12,000 in 15 years. Using time value of money and assuming you could invest your money elsewhere for a 7 percent annual yield, calculate the net cost of insurance. Use Exhibit 1-B. (Do not round intermediate calculations. Round time value factor to 3 decimal places and final answer to the nearest whole number.)

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

Which of the following correctly describes the accounting for indirect labor costs? indirect labor costs are product costs and are expensed as incurred. indirect labor costs are period costs and are expensed when the manufactured product is sold. indirect labor costs are period costs and are expensed as incurred. indirect labor costs are product costs and are expensed when the manufactured product is sold.

Answers: 3

Business, 22.06.2019 02:00

Greater concern for innovation and quality has shifted the job trend to using more broadly defined jobs. t/f

Answers: 1

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 22:00

The company is experiencing an increase in competition, and at the same time they are building more production facilities in southeast asia. in this scenario, the top management team is most likely to multiple choice increase the cost of their products. restructure to reflect a more bureaucratic, stable organization. pull decision-making responsibility from low-level management, taking it on themselves. give lower-level managers the authority to make decisions to benefit the firm. rid themselves of all buffering product.

Answers: 3

You know the right answer?

Suppose you are 45 and have a $50,000 face amount, 15-year, limited-payment, participating policy (d...

Questions

Mathematics, 17.10.2021 02:20

History, 17.10.2021 02:20

English, 17.10.2021 02:20

Mathematics, 17.10.2021 02:20

Mathematics, 17.10.2021 02:20

English, 17.10.2021 02:20

History, 17.10.2021 02:20

Mathematics, 17.10.2021 02:20

Mathematics, 17.10.2021 02:20

Mathematics, 17.10.2021 02:20