Business, 10.03.2020 07:46 nyasiasaunders1234

Calvin reviewed his canceled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005.

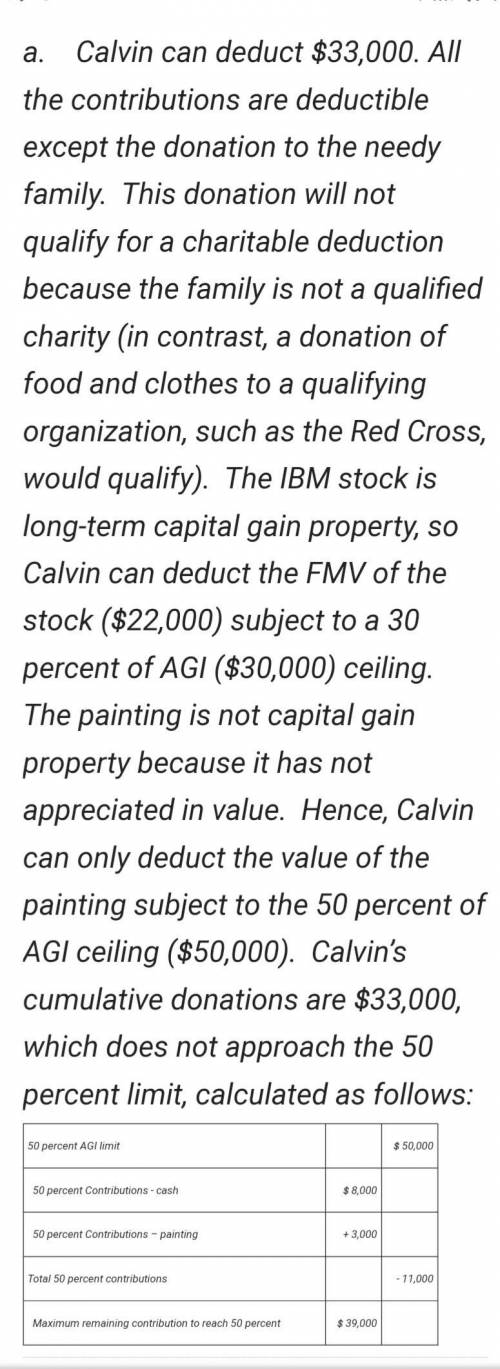

Donee Item Cost FMV

Hobbs Medical-

Center IBM stock $5,000 $22,000

State Museum Painting 5,000 3,000

A needy family Food and clothes 400 250

United Way Cash 8,000 8,000

Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances:

(A) Calvin’s AGI is $100,000

(B) Calvin’s AGI is $100,000 but the State Museum told Calvin that it plans to sell the painting

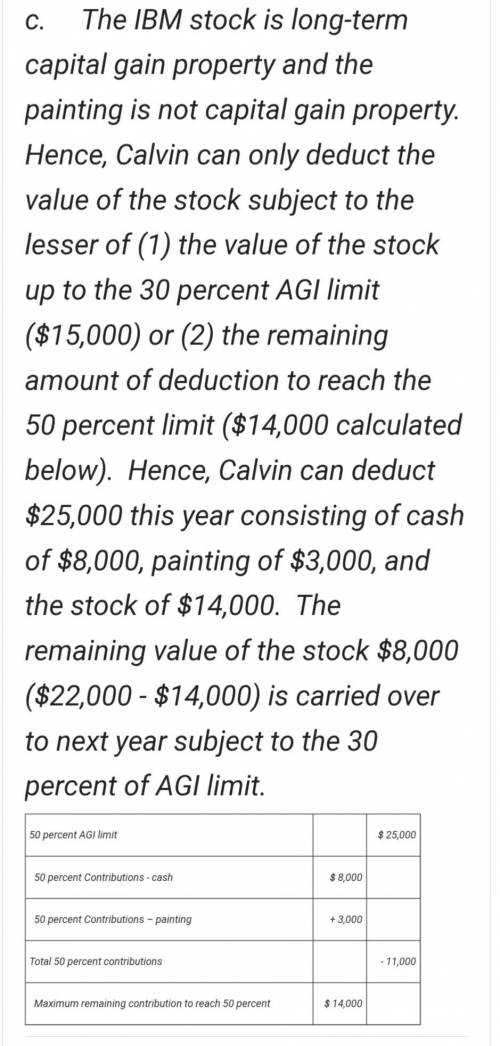

(C) Calvin’s AGI is $50,000.

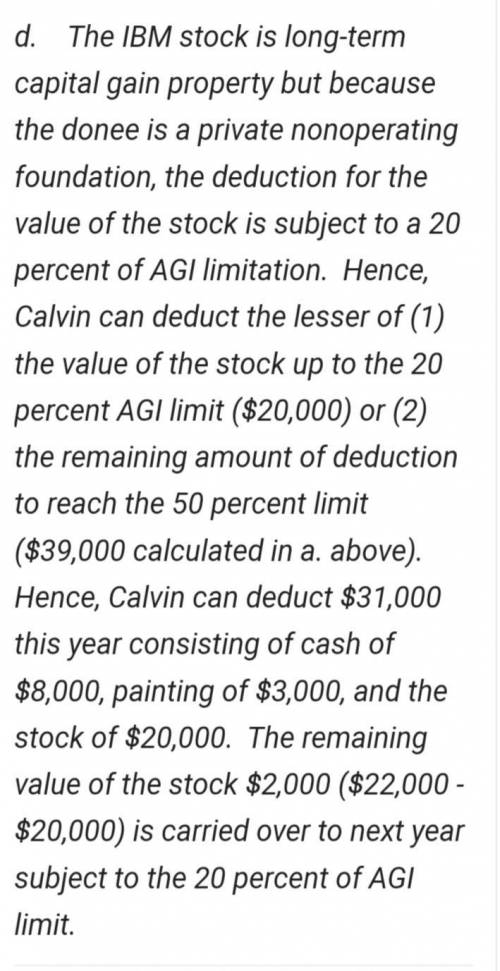

(D) Calvin’s AGI is $100,000 and Hobbs is a nonoperating private foundation.

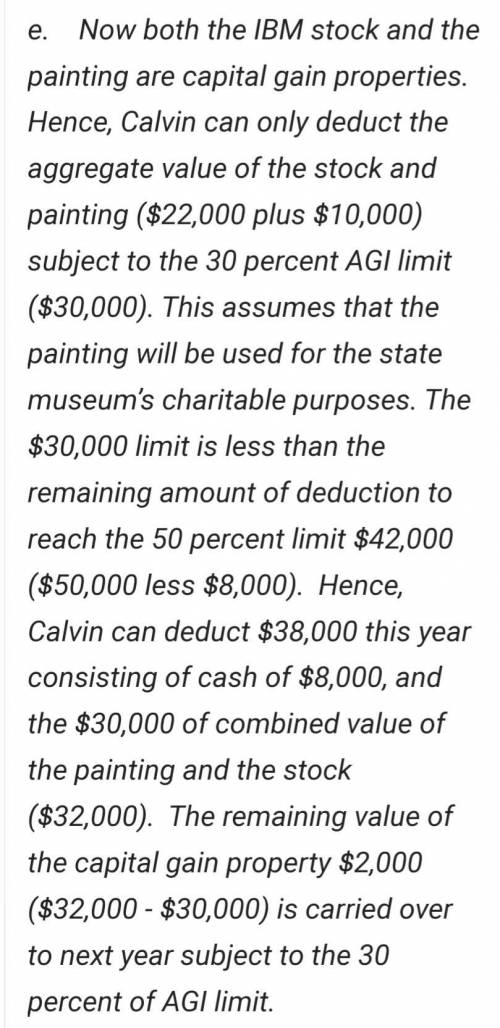

(E) Calvin’s AGI is $100,000 but the painting is worth $10,000.

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

Greater concern for innovation and quality has shifted the job trend to using more broadly defined jobs. t/f

Answers: 1

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 15:00

Ineed this asap miguel's boss asks him to distribute information to the entire staff about a mandatory meeting. in 1–2 sentences, describe what miguel should do.

Answers: 1

You know the right answer?

Calvin reviewed his canceled checks and receipts this year for charitable contributions, which inclu...

Questions

Advanced Placement (AP), 29.01.2020 01:08

Business, 29.01.2020 01:08

History, 29.01.2020 01:08

Mathematics, 29.01.2020 01:08

Arts, 29.01.2020 01:08