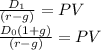

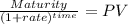

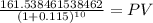

"Finance3000" is a young start-up company. It will not pay any dividends on its stock over the next nine years because it plans to use retained earnings on expanding its business. "Finance3000" will pay a $10 per share dividend 10 years from today. After that the company will increase the dividend by 5 percent per year, in perpetuity. The required return on this stock is 11.5 percent. Calculate the value of one share of "Finance3000"'s stock. (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 3

Another question on Business

Business, 21.06.2019 21:20

20. sinclair company's single product has a selling price of $25 per unit. last year the company reported a profit of $20,000 and variable expenses totaling $180,000. the product has a 40% contribution margin ratio. because of competition, sinclair company will be forced in the current year to reduce its selling price by $2 per unit. how many units must be sold in the current year to earn the same profit as was earned last year? a. 15,000 units b. 12,000 units c. 16,500 units d. 12,960 units

Answers: 1

Business, 22.06.2019 15:10

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 23.06.2019 08:30

Blake edwards has done some research and has discovered that economists believe interest rates will rise significantly over the next two years. blake believes that this will lead to fewer homes being sold and fewer jobs in the banking and mortgage industries. this is an example of influencing jobs in the future.

Answers: 1

Business, 23.06.2019 11:00

Which of the following makes a true statement about the relationship between government and financial institutions? government and financial institutions do not interact with each other. financial institutions like the u.s. treasury must approve increases in the government deficit. government can pass laws to limit what financial institutions can charge in interest and fees. financial institutions like local banks must approve interest rates set by the federal reserve.

Answers: 2

You know the right answer?

"Finance3000" is a young start-up company. It will not pay any dividends on its stock over the next...

Questions

Mathematics, 03.12.2020 20:30

Mathematics, 03.12.2020 20:30

Mathematics, 03.12.2020 20:30

Mathematics, 03.12.2020 20:30

Arts, 03.12.2020 20:30

Mathematics, 03.12.2020 20:30

History, 03.12.2020 20:30

Business, 03.12.2020 20:30

Mathematics, 03.12.2020 20:30

Computers and Technology, 03.12.2020 20:30

History, 03.12.2020 20:30

Mathematics, 03.12.2020 20:30

Mathematics, 03.12.2020 20:30