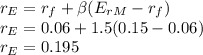

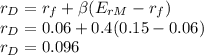

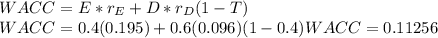

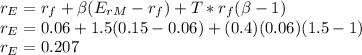

Consider a company which has β equity = 1.5 and β debt = 0.4. Suppose that the risk-free rate of interest is 6%, the expected return on the market E ( r M ) = 15%, and that the corporate tax rate is 40%. If the company has 40% equity and 60% debt in its capital structure, calculate its weighted average cost of capital using both the classic CAPM and the taxadjusted CAPM.

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

How will firms solve the problem of an economic surplus a. decrease prices to the market equilibrium price b. decrease prices so they are below the market equilibrium price c.increase prices

Answers: 3

Business, 22.06.2019 09:30

Darlene has a balance of 3980 on a credit card with an apr of 22.8% paying off her balance and which of these lengths of time will result in her paying the least amount of interest?

Answers: 2

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

Business, 22.06.2019 22:10

jackie's snacks sells fudge, caramels, and popcorn. it sold 12,000 units last year. popcorn outsold fudge by a margin of 2 to 1. sales of caramels were the same as sales of popcorn. fixed costs for jackie's snacks are $14,000. additional information follows: product unit sales prices unit variable cost fudge $5.00 $4.00 caramels $8.00 $5.00 popcorn $6.00 $4.50 the breakeven sales volume in units for jackie's snacks is

Answers: 1

You know the right answer?

Consider a company which has β equity = 1.5 and β debt = 0.4. Suppose that the risk-free rate of int...

Questions

Mathematics, 05.11.2020 23:20

Mathematics, 05.11.2020 23:20

Mathematics, 05.11.2020 23:20

Mathematics, 05.11.2020 23:20

Mathematics, 05.11.2020 23:20

Mathematics, 05.11.2020 23:20

Mathematics, 05.11.2020 23:20

Mathematics, 05.11.2020 23:20

Social Studies, 05.11.2020 23:20

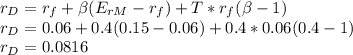

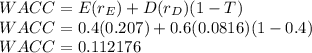

, cost of debt

, cost of debt is the cost of equity

is the cost of equity risk free rate

risk free rate is the volatility

is the volatility is the market return

is the market return