Business, 07.03.2020 04:57 netflixacc0107

A lease agreement that qualifies as a finance lease calls for annual lease payments of $10,000 over a five-year lease term (also the asset’s useful life), with the first payment at January 1, 2016, the beginning of the lease. The interest rate is 4%. The lessor’s fiscal year is the calendar year. The lessor manufactured this asset at a cost of $30,000. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

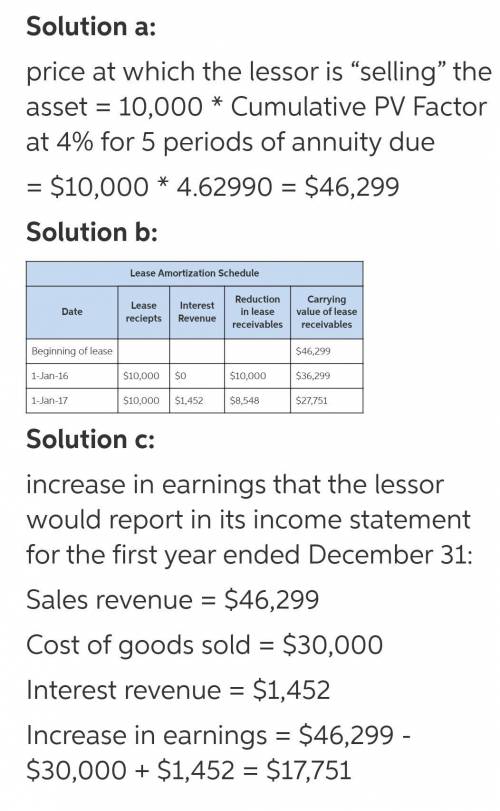

a. Determine the price at which the lessor is "selling" the asset (present value of the lease payments).

b. Create a partial amortization schedule through the second payment on January 1, 2017.

c. What would be the increase in earnings that the lessor would report in its income statement for the first year ended December 31 (ignore taxes)?

Answers: 1

Another question on Business

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 22:30

When the price is the equilibrium price, we would expect there to be a causing the market to put pressure on the price until it went back to the equilibrium price. a. above; surplus; upward b. above; shortage; downward c. below; surplus; upward d. below; shortage; downward e. above; surplus; downward?

Answers: 2

Business, 23.06.2019 00:30

What level of measurement (nominal, ordinal, interval, ratio) is appropriate for the movie rating system that you see in tv guide?

Answers: 2

Business, 23.06.2019 02:30

Organizations typically rely on schedules, such as hourly wages and annual reviews and raises.

Answers: 2

You know the right answer?

A lease agreement that qualifies as a finance lease calls for annual lease payments of $10,000 over...

Questions

Mathematics, 01.04.2020 07:03

Mathematics, 01.04.2020 07:03

Mathematics, 01.04.2020 07:04

History, 01.04.2020 07:04

Mathematics, 01.04.2020 07:04

Mathematics, 01.04.2020 07:04

Chemistry, 01.04.2020 07:04

Mathematics, 01.04.2020 07:04

Mathematics, 01.04.2020 07:04

Mathematics, 01.04.2020 07:04