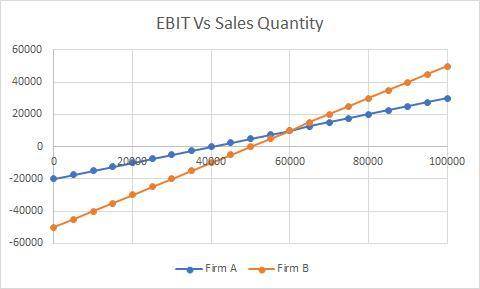

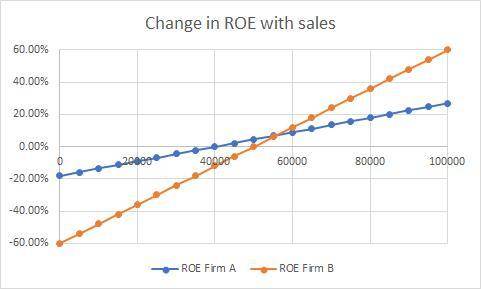

Consider two firms. Firm A has a DOL of 3.0, an expected ROE of 9% with a standard deviation of 6%, and an EBIT of $10,000 when sales are 60,000 units. Firm B has a DOL of 6.0, an expected ROE of 12% with a standard deviation of 15%, and an EBIT of $10,000 when sales are 60,000 units. On the same graph, depict EBIT as a function of sales for the two firms. On a separate graph, depict the distribution of ROE for the two firms. Calculate the coefficient of variation for both firms.

Answers: 3

Another question on Business

Business, 22.06.2019 05:30

Eliza works for a consumer agency educating young people about advertisements. instead of teaching students to carefully read advertisement claims, she encourages them to develop a strong sense of self and to keep their life goals and dreams separate from commercial products. why might eliza's advice make sense?

Answers: 2

Business, 22.06.2019 11:00

Consider an economy where government expenditures are 10 and total tax revenues are 10. the supply of labor is fixed at 125 and the supply of capital is fixed at 8. the economy is described by the following equations. y k to the power of 1 divided by 3 end exponent l to the power of 2 divided by 3 end exponent c 2.5 + 0.75 ( y - t ) i 10 - 0.5 r the level of private savings is

Answers: 1

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 14:10

Carey company is borrowing $225,000 for one year at 9.5 percent from second intrastate bank. the bank requires a 15 percent compensating balance. the principal refers to funds the firm can effectively utilize (amount borrowed − compensating balance). a. what is the effective rate of interest? (use a 360-day year. input your answer as a percent rounded to 2 decimal places.) b. what would the effective rate be if carey were required to make 12 equal monthly payments to retire the loan?

Answers: 1

You know the right answer?

Consider two firms. Firm A has a DOL of 3.0, an expected ROE of 9% with a standard deviation of 6%,...

Questions

History, 19.10.2019 08:50

Social Studies, 19.10.2019 08:50

Mathematics, 19.10.2019 08:50

Chemistry, 19.10.2019 08:50

Geography, 19.10.2019 08:50

Mathematics, 19.10.2019 08:50

History, 19.10.2019 08:50

Mathematics, 19.10.2019 08:50

Biology, 19.10.2019 08:50

World Languages, 19.10.2019 08:50

Mathematics, 19.10.2019 08:50

Biology, 19.10.2019 08:50

Biology, 19.10.2019 08:50