Anne Cleves Company reported the following amounts in the stockholders’ equity section of its December 31, 2013, balance sheet. Preferred stock, 11%, $100 par (10,000 shares authorized, 2,280 shares issued) $228,000 Common stock, $5 par (127,550 shares authorized, 25,510 shares issued) 127,550 Additional paid-in capital 134,400 Retained earnings 478,700 Total $968,650 During 2014, Cleves took part in the following transactions concerning stockholders’ equity.

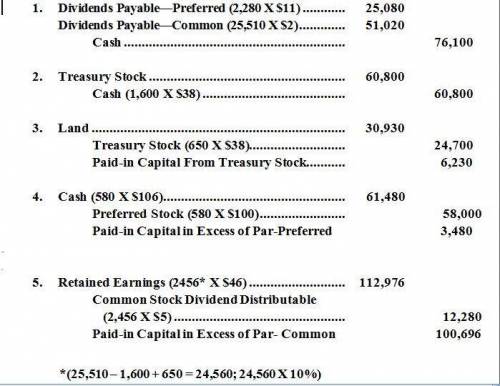

1. Paid the annual 2013 $11 per share dividend on preferred stock and a $2 per share dividend on common stock. These dividends had been declared on December 31, 2013.

2. Purchased 1,600 shares of its own outstanding common stock for $38 per share. Cleves uses the cost method.

3. Reissued 650 treasury shares for land valued at $30,930.

4. Issued 580 shares of preferred stock at $106 per share.

5. Declared a 10% stock dividend on the outstanding common stock when the stock is selling for $46 per share.

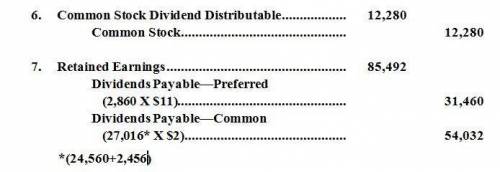

6. Issued the stock dividend.

7. Declared the annual 2014 $11 per share dividend on preferred stock and the $2 per share dividend on common stock. These dividends are payable in 2015.

(a) Prepare journal entries to record the transactions described above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

(b) Prepare the December 31, 2014, stockholders’ equity section. Assume 2014 net income was $334,600. (Enter account name only .Do not provide any descriptive information.)

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

The beach dude (bd) employs a legion of current and former surfers as salespeople who push its surfing-oriented products to various customers (usually retail outlets). this case describes bd's sales and collection process. each bd salesperson works with a specific group of customers throughout the year. in fact, they often surf with their customers to try out the latest surf gear. the bd salespeople act laid-back, but they work hard for their sales. each sale often involves hours of surfing with their customers while the customers sample all the latest surf wear. because bd makes the best surfing products, the customers look forward to the visits from the bd salespeople. and they often buy a lot of gear. each sale is identified by a unique invoice number and usually involves many different products. customers pay for each sale in full within 30 days, but they can combine payments for multiple sales. bd manages its clothing inventory by item (e.g., xl bd surfer logo t-shirts), identified by product number, but it also classifies the items by clothing line (the lines are differentiated by price points as well as the intended use of the clothing, e.g., surfing products, casual wear, . draw a uml class diagram that describes the beach dudes sales and collection process.b. using microsoft access, implement a relational database from your uml class diagram. identify at least three fields per table.c. describe how you would use the relational database to determine the beach dude’s accounts receivable.

Answers: 3

Business, 22.06.2019 06:00

When an interest-bearing note comes due and is uncollectible, the journal entry includes debitingaccounts receivable and crediting notes receivable and interest revenue.accounts receivable and crediting interest revenue.notes receivable and crediting accounts receivable and interest revenue.notes receivable and crediting accounts receivable.

Answers: 3

Business, 22.06.2019 06:30

Selected data for stick’s design are given as of december 31, year 1 and year 2 (rounded to the nearest hundredth). year 2 year 1 net credit sales $25,000 $30,000 cost of goods sold 16,000 18,000 net income 2,000 2,800 cash 5,000 900 accounts receivable 3,000 2,000 inventory 2,000 3,600 current liabilities 6,000 5,000 compute the following: 1. current ratio for year 2 2. acid-test ratio for year 2 3. accounts receivable turnover for year 2 4. average collection period for year 2 5. inventory turnover for year 2

Answers: 2

Business, 22.06.2019 07:40

Shelby company produces three products: product x, product y, and product z. data concerning the three products follow (per unit): product x product y product z selling price $ 85 $ 65 $ 75 variable expenses: direct materials 25.50 19.50 5.25 labor and overhead 25.50 29.25 47.25 total variable expenses 51.00 48.75 52.50 contribution margin $ 34.00 $ 16.25 $ 22.50 contribution margin ratio 40 % 25 % 30 % demand for the company’s products is very strong, with far more orders each month than the company can produce with the available raw materials. the same material is used in each product. the material costs $8 per pound, with a maximum of 4,400 pounds available each month. required: a. compute contribution margin per pound of materials used. (round your intermediate calculations and final answers to 2 decimal places.) contribution margin per pound product x $ product y $ product z $ b. which orders would you advise the company to accept first, those for product x, for product y, or for product z? which orders second? third? product x product y product z

Answers: 3

You know the right answer?

Anne Cleves Company reported the following amounts in the stockholders’ equity section of its Decemb...

Questions

Mathematics, 31.01.2020 22:44

Mathematics, 31.01.2020 22:44

Mathematics, 31.01.2020 22:44

History, 31.01.2020 22:44

Health, 31.01.2020 22:44

Geography, 31.01.2020 22:44

History, 31.01.2020 22:44

Mathematics, 31.01.2020 22:44

Mathematics, 31.01.2020 22:44

History, 31.01.2020 22:44

Social Studies, 31.01.2020 22:44

History, 31.01.2020 22:44

History, 31.01.2020 22:44

Biology, 31.01.2020 22:44

Mathematics, 31.01.2020 22:44

World Languages, 31.01.2020 22:44

English, 31.01.2020 22:44