Business, 06.03.2020 23:58 emojigirl2824

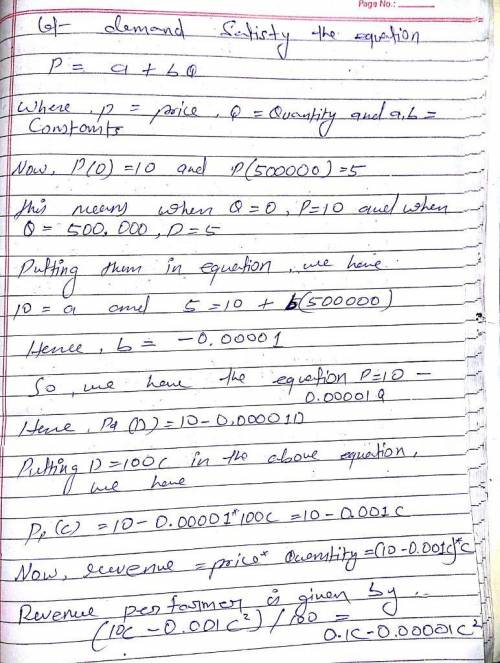

A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested by every farmer depends on the weather: sunny weather yields more com than cloudy weather during the growing season. All corn is harvested simultaneously, and the price per bushel is determined by a market demand function. Suppose the price dem and function P = Pl(D) is such that Pa (0-10 dollars and Pa (500000-5 dollars, and Pi (D) is linear in D, the demand in bushels. Then (1) price in terms of demand Pd(D10-0.000010 dollars Through supply and demand equality, the demand equals the total crop size. The amounts produced on different farms are all perfectly correlated and there are a total of 100 farms, and thus D- 100C, Then (2) price in terms of production P Then from selling the crop, each farmer has (3) revenue from production Rp(C) - dollars IC- 00001C"(2) dollars This shows that the revenue is a nonlinear function of the underlying variable C. Because of the weather, C is random and each farmer faces nonlinear risk. Can a farmer hedge this risk in advance by participating in the futures market for corn? Since the farmer is ultimately going to sell his corn harvest at the (risky) spot price, it might be prudent to sell some corn now at a known price in the futures market. Indeed, if the farmer knew exactly how much con he would produce, and only the price were uncertain, he could implement an equal and opposite policy by shorting this amount in the corn futures market. Let C be the expected corn production. Let P Pp(C) be the expected price at future time T Suppose the farmer enters into h corn future contracts, where < 0 represents the sale of (-h) > 0 bushels of corn at time T for P per bushel, and h > 0 represents purchase of h bushels of corn at time T for P per bushel

Answers: 1

Another question on Business

Business, 21.06.2019 22:00

When slick heating company switched to an activity based costing system, it realized that it was allocating a much lower percentage of factory overhead to a product line that the marketing department was trying to push. the product line may contain which type of products?

Answers: 2

Business, 22.06.2019 06:50

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

Business, 22.06.2019 08:20

Which change is illustrated by the shift taking place on this graph? a decrease in supply an increase in supply o an increase in demand o a decrease in demand

Answers: 3

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

You know the right answer?

A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested...

Questions

Biology, 15.03.2020 20:25

Mathematics, 15.03.2020 20:25

Business, 15.03.2020 20:30

Mathematics, 15.03.2020 20:31

History, 15.03.2020 20:33

Mathematics, 15.03.2020 20:33

Mathematics, 15.03.2020 20:33

Mathematics, 15.03.2020 20:34

Physics, 15.03.2020 20:34