Business, 07.03.2020 00:25 KingREGEVER7446

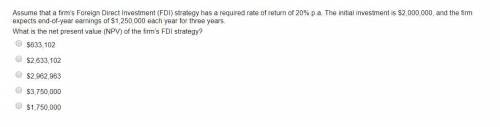

Assume that a firm's Foreign Direct Investment (FDI) strategy has a required rate of return of 20% p. a. The initial investment is $2,000,000, and the firm expects end-of-year earnings of $1,250,000 each year for three years. What is the net present value (NPV) of the firm's FDI strategy? a. $2,633,102 b. $2,962,963 c. $3,750,000 d. $1,750,000

Answers: 1

Another question on Business

Business, 22.06.2019 15:20

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 24.06.2019 10:30

11. problems and applications q11 consider how health insurance affects the quantity of health care services performed. suppose that the typical medical procedure has a cost of $160, yet a person with health insurance pays only $40 out of pocket. her insurance company pays the remaining $120. (the insurance company recoup the $120 through premiums, but the premium a person pays does not depend on how many procedures that person chooses to undergo.) consider the following demand curve in the market for medical care. use the black point (plus symbol) to indicate the quantity of procedures demanded if each procedure has a price of $160. then use the grey point (star symbol) to indicate the quantity of procedures demanded if each procedure has a price of $40.

Answers: 3

You know the right answer?

Assume that a firm's Foreign Direct Investment (FDI) strategy has a required rate of return of 20% p...

Questions

Mathematics, 06.05.2020 21:23

Mathematics, 06.05.2020 21:24

Mathematics, 06.05.2020 21:24

Mathematics, 06.05.2020 21:24

Biology, 06.05.2020 21:24

Biology, 06.05.2020 21:24