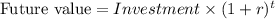

You receive a $11 comma 000 check from your grandparents for graduation. You decide to save it toward a down payment on a house. You invest it earning 9% per year and you think you will need to have $22 comma 000 saved for the down payment. How long will it be before the $11 comma 000 has grown to $22 comma 000 ?

Answers: 3

Another question on Business

Business, 22.06.2019 04:30

Required prepare the necessary adjusting entries in the general journal as of december 31, assuming the following: on september 1, the company entered into a prepaid equipment maintenance contract. birch company paid $3,400 to cover maintenance service for six months, beginning september 1. the payment was debited to prepaid maintenance. supplies on hand at december 31 are $3,900. unearned commission fees at december 31 are $7,000. commission fees earned but not yet billed at december 31 are $3,500. (note: debit fees receivable.) birch company's lease calls for rent of $1,600 per month payable on the first of each month, plus an annual amount equal to 1% of annual commissions earned. this additional rent is payable on january 10 of the following year. (note: be sure to use the adjusted amount of commissions earned in computing the additional rent.)

Answers: 1

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

Business, 23.06.2019 10:30

According to the graph, how much did individuals making $20,000 to $50,000 a year pay in income taxes? according to the graph, how much revenue did the government receive from individuals earning $200,000 and above?

Answers: 1

Business, 23.06.2019 16:00

On january 1, 2018, wetick optometrists leased diagnostic equipment from southern corp. which had purchased the equipment at a cost of $2,256,342. the lease agreement specifies six annual payments of $490,000 beginning january 1, 2018, the beginning of the lease, and at each december 31 thereafter through 2022. the six-year lease term ending december 31, 2023 (a year after the final payment), is equal to the estimated useful life of the equipment. the contract specifies that lease payments for each year will increase on the basis of the increase in the consumer price index for the year just ended. thus, the first payment will be $490,000, and the second and subsequent payments might be different. the cpi at the beginning of the lease is 120. southern routinely acquires diagnostic equipment for lease to other firms. the interest rate in these financing arrangements is 12%. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) prepare the appropriate journal entries for wetick and southern to record the lease at its beginning.

Answers: 3

You know the right answer?

You receive a $11 comma 000 check from your grandparents for graduation. You decide to save it towar...

Questions

Business, 06.07.2019 09:00

History, 06.07.2019 09:00

Mathematics, 06.07.2019 09:00

Chemistry, 06.07.2019 09:00

Chemistry, 06.07.2019 09:00

Spanish, 06.07.2019 09:00

English, 06.07.2019 09:00

Arts, 06.07.2019 09:00

Mathematics, 06.07.2019 09:00

History, 06.07.2019 09:00

Physics, 06.07.2019 09:00