Business, 06.03.2020 23:49 toricepeda82

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. Currently, the cost of producing each parka is estimated to be $55. This company is planning to produce approximately 2000 parkas in the next year. The quality manager of the company has estimated that, with the current situation, 15% of the parkas produced will be defective and only 60% of the defective parkas can be reworked. The rework cost is estimated to be $10.

The quality management department has suggested to upgrade the sewing machine to reduce the percentage of defective items. With this upgrade, the cost of producing each parka will be 60$ and the percentage of defective items will be 8%. The rework cost and the percentage of defective items that can be reworked do not change with this upgrade.

Calculate:

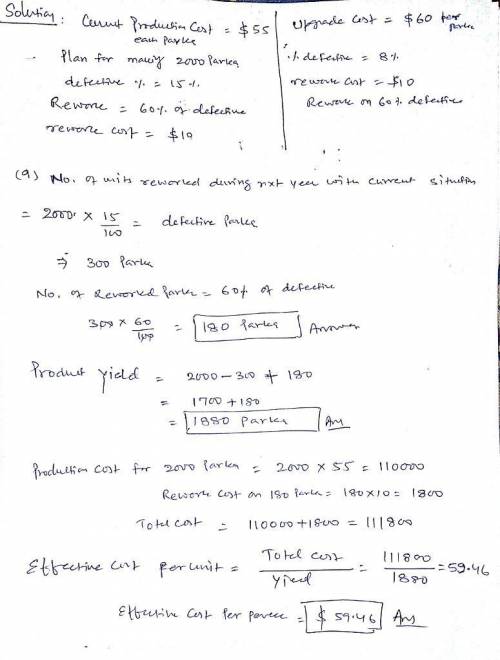

Number of units reworked during the next year, with the current situation:

Product yield during the next year, with the current situation:

Effective per unit production cost, with the current situation:

If the company wants the yield to be 2000, how many parkas they should plan to produce during the next year, with the current situation?

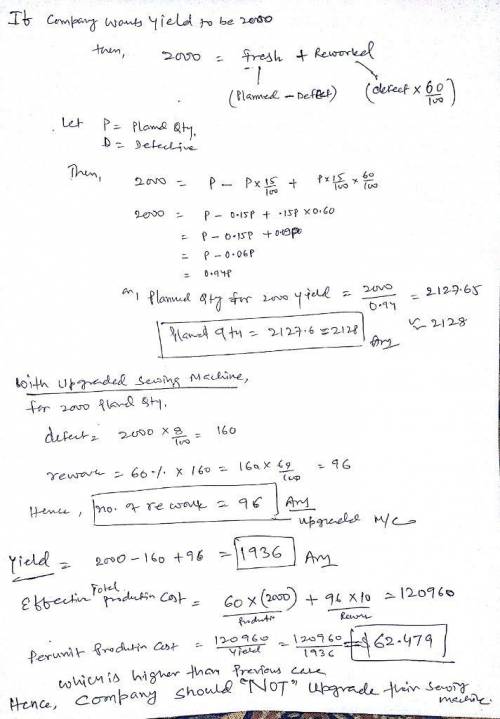

Number of units reworked annually with the upgraded sewing machine:

The Yield during the next year with the upgraded sewing machine:

Effective per unit production cost per with the upgraded sewing machine:

Should the company upgrade their sewing machine?

Yes

No

Answers: 3

Another question on Business

Business, 21.06.2019 17:30

The digby's workforce complement will grow by 20% (rounded to the nearest person) next year. ignoring downsizing from automating, what would their total recruiting cost be? assume digby spends the same amount extra above the $1,000 recruiting base as they did last year. select: 1 $2,840,000 $3,408,000 $570,000 $475,000

Answers: 1

Business, 21.06.2019 18:30

Beta coefficients and the capital asset pricing model personal finance problem katherine wilson is wondering how much risk she must undertake to generate an acceptable return on her porfolio. the risk-free return currently is 4%. the return on the overall stock market is 14%. use the capm to calculate how high the beta coefficient of katherine's portfolio would have to be to achieve a portfolio return of 16%.

Answers: 2

Business, 21.06.2019 22:20

If you offer up your car as a demonstration that you will pay off your loan to a bank or another financial lending institution, you are using your car as collateral. true false

Answers: 2

Business, 22.06.2019 17:00

Zeta corporation is a manufacturer of sports caps, which require soft fabric. the standards for each cap allow 2.00 yards of soft fabric, at a cost of $2.00 per yard. during the month of january, the company purchased 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. what is zeta corporation's materials price variance for the month of january?

Answers: 2

You know the right answer?

Backwoods American, Inc., produces expensive water-repellent, down-lined parkas. Currently, the cost...

Questions

Mathematics, 23.07.2021 22:40

Mathematics, 23.07.2021 22:40

Computers and Technology, 23.07.2021 22:40

Mathematics, 23.07.2021 22:40

Computers and Technology, 23.07.2021 22:40

Advanced Placement (AP), 23.07.2021 22:40

World Languages, 23.07.2021 22:40

Mathematics, 23.07.2021 22:40

Mathematics, 23.07.2021 22:40