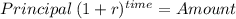

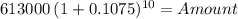

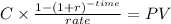

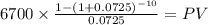

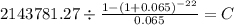

You are planning your retirement in 10 years. You currently have $173,000 in a bond account and $613,000 in a stock account. You plan to add $6,700 per year at the end of each of the next 10 years to your bond account. The stock account will earn a return of 10.75 percent and the bond account will earn a return of 7.25 percent.

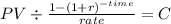

When you retire, you plan to withdraw an equal amount for each of the next 22 years at the end of each year and have nothing left. Additionally, when you retire you will transfer your money to an account that earns 6.5 percent.

1. How much can you withdraw each year in your retirement?

Answers: 2

Another question on Business

Business, 21.06.2019 19:10

King fisher aviation is evaluating an investment project with the following case flows: $6,000 $5,500 $7,000 $8,000 discount rate 14 percent what is the discounted payback period for these cash flows if the initial cost is 15,000? what if the initial cost is $12,000? what if the cost is $16,000?

Answers: 1

Business, 22.06.2019 15:30

Careers in designing, planning, managing, building and maintaining the built environment can be found in the following career cluster: a. agriculture, food & natural resources b. architecture & construction c. arts, audio-video technology & communications d. business, management & administration

Answers: 2

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 23.06.2019 06:30

Transferable skills necessary for successful employment include a. basic skills b. thinking skills c. personal qualities d. all of the above select the best answer from the choices provided

Answers: 1

You know the right answer?

You are planning your retirement in 10 years. You currently have $173,000 in a bond account and $613...

Questions

Computers and Technology, 27.01.2020 20:31

Geography, 27.01.2020 20:31

Mathematics, 27.01.2020 20:31

Biology, 27.01.2020 20:31

Mathematics, 27.01.2020 20:31

Mathematics, 27.01.2020 20:31

English, 27.01.2020 20:31

Mathematics, 27.01.2020 20:31