Business, 06.03.2020 06:28 mateoperez496

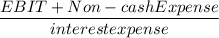

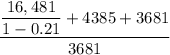

Pop Evil Inc.’s net income for the most recent year was $16,481. The tax rate was 21 percent. The firm paid $3,681 in total interest expense and deducted $4,385 in depreciation expense. What was the cash coverage ratio for the year? (

Answers: 3

Another question on Business

Business, 21.06.2019 22:10

Fess receives wages totaling $74,500 and has net earnings from self-employment amounting to $71,300. in determining her taxable self-employment income for the oasdi tax, how much of her net self-employment earnings must fess count? a. $74,500 b. $71,300 c. $53,900 d. $127,200 e. none of the above.

Answers: 3

Business, 22.06.2019 08:30

Match the items with the actions necessary to reconcile the bank statement.(there's not just one answer)1. interest credited in bank account2. fee charged by bank for returned check3. checks issued but not deposited4. deposits yet to be crediteda. add to bank statementb. deduct from bank statementc. add to personal statementd. deduct from personal statement

Answers: 2

Business, 22.06.2019 11:10

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

Business, 22.06.2019 17:00

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

You know the right answer?

Pop Evil Inc.’s net income for the most recent year was $16,481. The tax rate was 21 percent. The fi...

Questions

Biology, 14.04.2021 14:00

Computers and Technology, 14.04.2021 14:00

Chemistry, 14.04.2021 14:00

Social Studies, 14.04.2021 14:00

Physics, 14.04.2021 14:00

Social Studies, 14.04.2021 14:00

Biology, 14.04.2021 14:00

Computers and Technology, 14.04.2021 14:00

English, 14.04.2021 14:00

Mathematics, 14.04.2021 14:00

Mathematics, 14.04.2021 14:00

Computers and Technology, 14.04.2021 14:00

Mathematics, 14.04.2021 14:00

Mathematics, 14.04.2021 14:00

Mathematics, 14.04.2021 14:00

Mathematics, 14.04.2021 14:00

Spanish, 14.04.2021 14:00