Business, 03.03.2020 00:24 issagirl05

Land in the Marcellus Shale natural gas play is currently leasing for $10,000 per acre. 100 acres are needed in order to drill for natural gas. Leases last for three years, and if no drilling occurs within those three years then the land goes back on the market. In other words, if a lease is signed in Year 0, then the company holding the lease must drill and complete a well in Year 0, Year 1 or Year 2. If this does not happen then the lease expires at the end of Year 2 and that parcel of land can be re-leased.

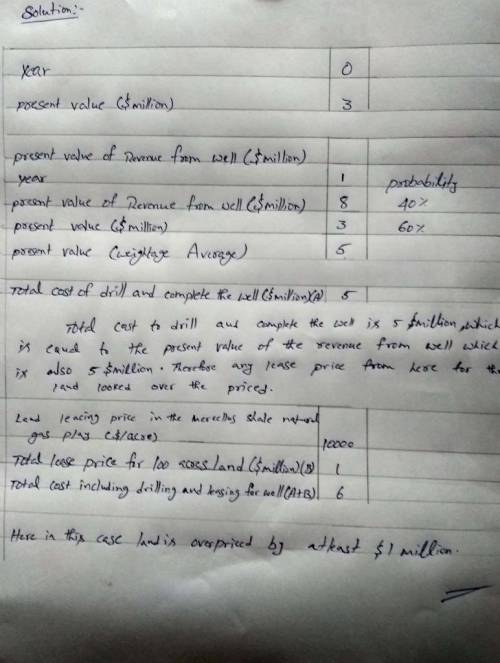

The cost to drill and complete a well is $5 million, incurred entirely in the year in which the well is drilled. There are no other operating costs to extract natural gas other than the drilling and completion. Currently (in Year 0), the present value of the revenues from the gas well are $3 million. Each year, there is a 40% probability that the present value of revenues will go up to $8 million for a well drilled in that year, and a 60% probability that the present value of revenues will be $3 million for a well drilled in that year.

Calculate the value of a 100 acre parcel of land in the current year (Year 0). Remember that leasing in Year 0 gives you the option to drill in Year 0, Year 1 or Year 2. Also remember that to calculate the value of the land you need to make a comparison with a scenario where you lease the land in Year 0 and are committed to drilling in Year 0. Does land appear to be over-priced, under-priced, or priced correctly? Please use a 10% discount rate per year.

Answers: 1

Another question on Business

Business, 21.06.2019 22:40

Which economic indicators are used to measure the global economy? check all that apply. a. purchasing power parity b. trade volumes c. spending power parity d. labor market data e. gross domestic product f. trade deficits and surpluses

Answers: 3

Business, 22.06.2019 02:00

Precision dyes is analyzing two machines to determine which one it should purchase. the company requires a rate of return of 15 percent and uses straight-line depreciation to a zero book value over the life of its equipment. ignore bonus depreciation. machine a has a cost of $462,000, annual aftertax cash outflows of $46,200, and a four-year life. machine b costs $898,000, has annual aftertax cash outflows of $16,500, and has a seven-year life. whichever machine is purchased will be replaced at the end of its useful life. which machine should the company purchase and how much less is that machine's eac as compared to the other machine's

Answers: 3

Business, 22.06.2019 17:30

Which curve shows increasing opportunity cost as you give up more of one option? demand curve bow-shaped curve yield curve indifference curve

Answers: 3

Business, 22.06.2019 20:00

Experienced problem solvers always consider both the value and units of their answer to a problem. why?

Answers: 3

You know the right answer?

Land in the Marcellus Shale natural gas play is currently leasing for $10,000 per acre. 100 acres ar...

Questions

Business, 18.07.2020 04:01