Business, 02.03.2020 18:52 michellemonchez103

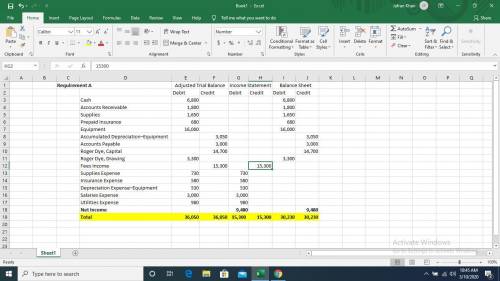

The adjusted ledger accounts of RD Consulting on December 31, 2019, appear as follows.

Account Name Balance

Cash 6,800

Accounts Receivable 1,800

Supplies 1,650

Prepaid Insurance 680

Equipment 16,000

Accumulated Depreciation–Equipment 3,050

Accounts Payable 3,000

Roger Dye, Capital 14,700

Roger Dye, Drawing 3,300

Fees Income 15,300

Supplies Expense 730

Insurance Expense 580

Depreciation Expense–Equipment 530

Salaries Expense 3,000

Utilities Expense 980

Prepare the Balance Sheet and Income Statement columns of the worksheet. Prepare the closing entries for RD Consulting on December 31, 2019. All accounts have normal balances and adjusting entries have been made.

Answers: 3

Another question on Business

Business, 21.06.2019 19:30

Consider the following ethical argument. which of the three statements represents the moral statement about a moral principle? statement 1: a dealership advertised a car at a very low price, but only had a similar higher priced model in stock. statement 2: it is wrong to perform a bait and switch. statement 3: the dealership was wrong to advertise the car on special sale when in actually it was not available.

Answers: 3

Business, 21.06.2019 21:00

The following accounts appeared in recent financial statements of delta air lines. identify each account as either a balance sheet account or an income statement account. for each balance sheet account, identify it as an asset, a liability, or stockholders' equity. for each income statement account, identify it as a revenue or an expense. item financial statement type of account accounts payable balance sheet advanced payments for equipment balance sheet air traffic liability balance sheet aircraft fuel (expense) income statement aircraft maintenance (expense) income statement aircraft rent (expense) income statement cargo revenue income statement cash balance sheet contract carrier arrangements (expense) income statement flight equipment balance sheet frequent flyer (obligations) balance sheet fuel inventory balance sheet landing fees (expense) income statement parts and supplies inventories balance sheet passenger commissions (expense) income statement passenger revenue income statement prepaid expenses income statement taxes payable balance sheet

Answers: 1

Business, 22.06.2019 03:00

Sonic corp. manufactures ski and snowboarding equipment. it has estimated that this year there will be substantial growth in its sales during the winter months. it approaches the bank for credit. what is the purpose of such credit known as? a. expansion b. inventory building c. debt management d. emergency maintenance

Answers: 1

You know the right answer?

The adjusted ledger accounts of RD Consulting on December 31, 2019, appear as follows.

A...

A...

Questions

Mathematics, 25.12.2019 17:31

Biology, 25.12.2019 17:31

Mathematics, 25.12.2019 17:31

History, 25.12.2019 17:31

Mathematics, 25.12.2019 17:31

Mathematics, 25.12.2019 17:31

Mathematics, 25.12.2019 17:31

Spanish, 25.12.2019 17:31

Business, 25.12.2019 17:31

World Languages, 25.12.2019 17:31