Business, 29.02.2020 01:02 travawnward

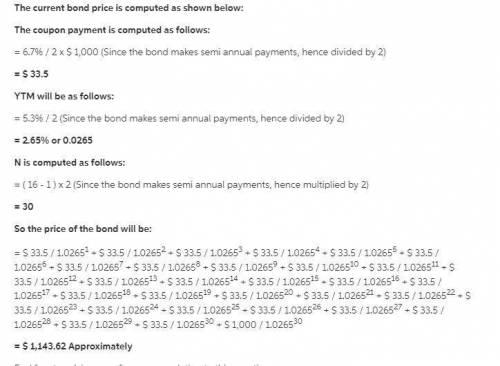

Dufner Co. issued 16-year bonds one year ago at a coupon rate of 6.7 percent. The bonds make semiannual payments. If the YTM on these bonds is 5.3 percent, what is the current dollar price assuming a par value of $1,000? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Agood for which demand increases as income rises is and a good for which demand increases as income falls is

Answers: 1

Business, 22.06.2019 08:30

An employer who is considering hiring eva has asked donna, eva’s former supervisor, for a report on eva. in truth, eva’s work for donna has been only average. however, eva is donna’s friend, and donna knows that eva probably will not get the job if she says anything negative about eva, and donna knows that eva desperately needs the job. further, donna knows that if the situation were reversed, she would not want eva to mention her deficiencies. nevertheless, it has been donna’s policy to reveal the deficiencies of employees when she has been asked for references by employers, and she knows that some of eva’s faults may be bothersome to this particular employer. finally, this employer has leveled with donna in the past when donna has asked for a report on people who have worked for him. should donna reveal deficiencies in eva’s past performance? (remember to use one of the three moral theories acceptable for this test to solve this dilemma. any discussion of any personal opinion, religious perspective, or theory other than the moral theories acceptable for this test will result in a score of "0" for this question.)

Answers: 1

Business, 22.06.2019 15:20

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

Business, 22.06.2019 22:00

Suppose that a paving company produces paved parking spaces (q) using a fixed quantity of land (t) and variable quantities of cement (c) and labor (l). the firm is currently paving 1,000 parking spaces. the firm's cost of cement is $3 comma 600.003,600.00 per acre covered (c) and its cost of labor is $35.0035.00/hour (w). for the quantities of c and l that the firm has chosen, mp subscript upper c baseline equals 60mpc=60 and mp subscript upper l baseline equals 7mpl=7. is this firm minimizing its cost of producing parking spaces?

Answers: 3

You know the right answer?

Dufner Co. issued 16-year bonds one year ago at a coupon rate of 6.7 percent. The bonds make semiann...

Questions

French, 13.11.2020 22:30

Mathematics, 13.11.2020 22:30

Geography, 13.11.2020 22:30

Mathematics, 13.11.2020 22:30

Mathematics, 13.11.2020 22:30

Health, 13.11.2020 22:30

Social Studies, 13.11.2020 22:30

Mathematics, 13.11.2020 22:30

Mathematics, 13.11.2020 22:30

Chemistry, 13.11.2020 22:30

Chemistry, 13.11.2020 22:30